EUR/JPY Price Analysis: Bears seeking a break of critical trendline support

- EUR/JPY bulls hand over control to the bears at the start of the day.

- Capped below 142.00, there are prospects of a break of key structure.

EUR/JPY bulls have failed to take advantage of the European Central Bank sentiment at the turn of the day with bears moving in for the kill from below the 142.00 resistance level. This is a major resistance zone and should the bulls fail to regain control, then there are prospects of a significant move to the downside for the rest of the week.

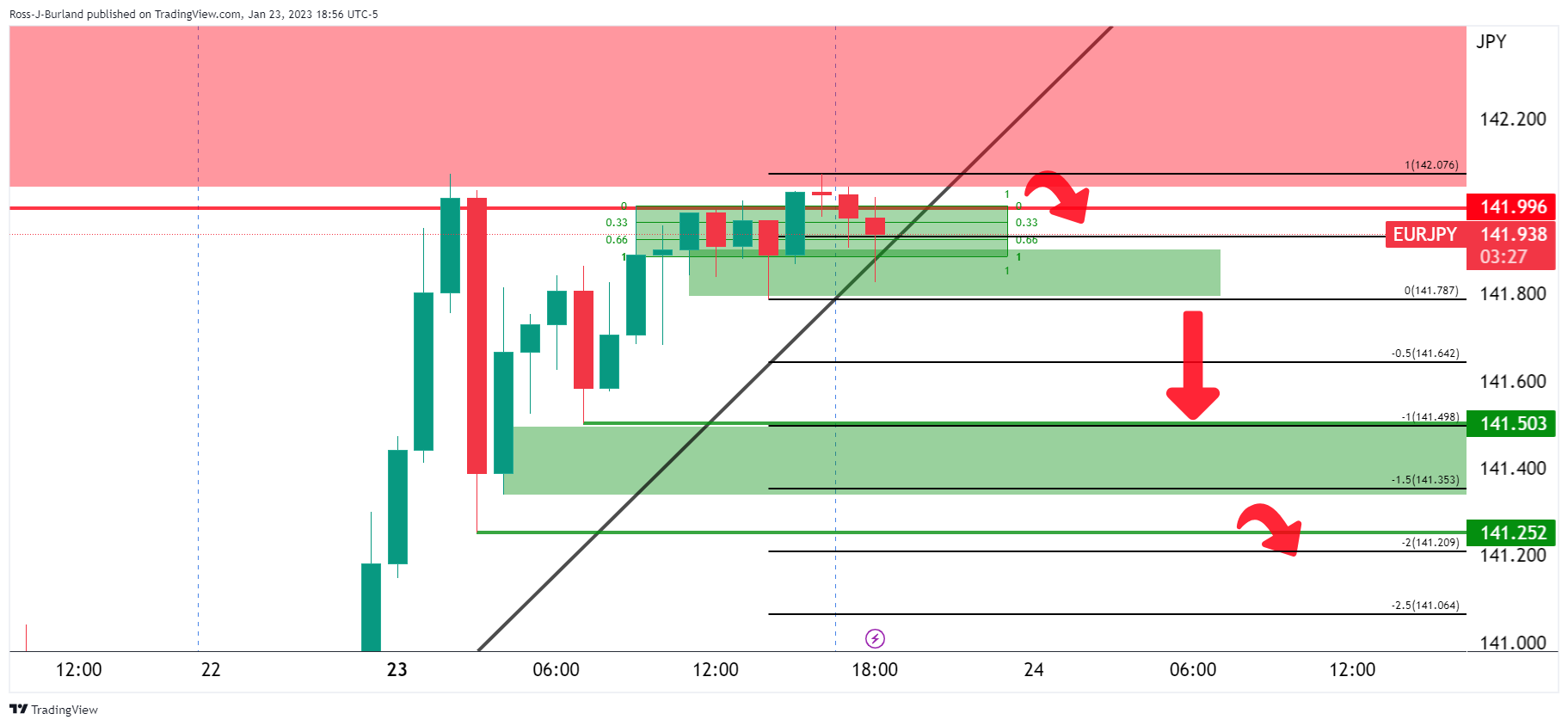

EUR/JPY H1 chart analysis

As per the charts above, the hourly time frame shows that the price is decelerating on the bid and testing critical trendline support. If this were to break, then the bear will be on the lookout for a structure to lean against t to target the 141.50 level to the downside. Measuring the current consolidation channel's range, a measured move of 100% of the range meets the target and also defends the way to the 141.20s.

On the other hand, if the bulls commit, then there will be prospects of a run to test 142.20 and then 142.50: