Back

25 Jan 2023

Crude Oil Futures: Room for extra losses near term

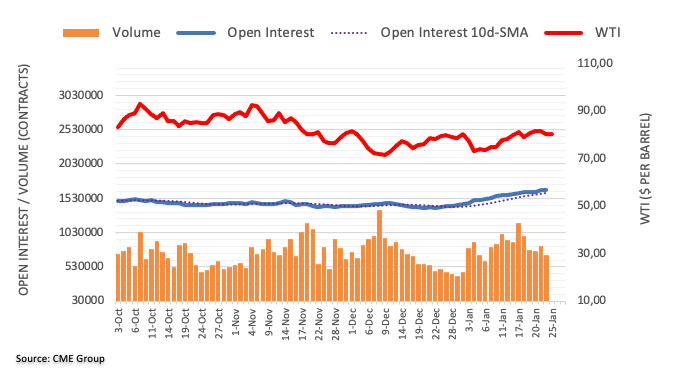

Considering advanced figures from CME Group for crude oil futures markets, traders added around 16.4K contracts to their open interest positions on Tuesday, clinching the third consecutive daily advance. On the other hand, volume resumed the downtrend and dropped by around 133.6K contracts.

WTI faces a minor support near $78.00

Prices of the WTI started the week on the back foot. Indeed, Tuesday’s moderate pullback was amidst increasing open interest, which is supportive of a deeper retracement in the very near term. That said, the weekly low near the $78.00 mark per barrel (January 19) now emerges as a potential next target fore the commodity.