GBP/USD Price Analysis: Bulls meet key resistance, bears lurking

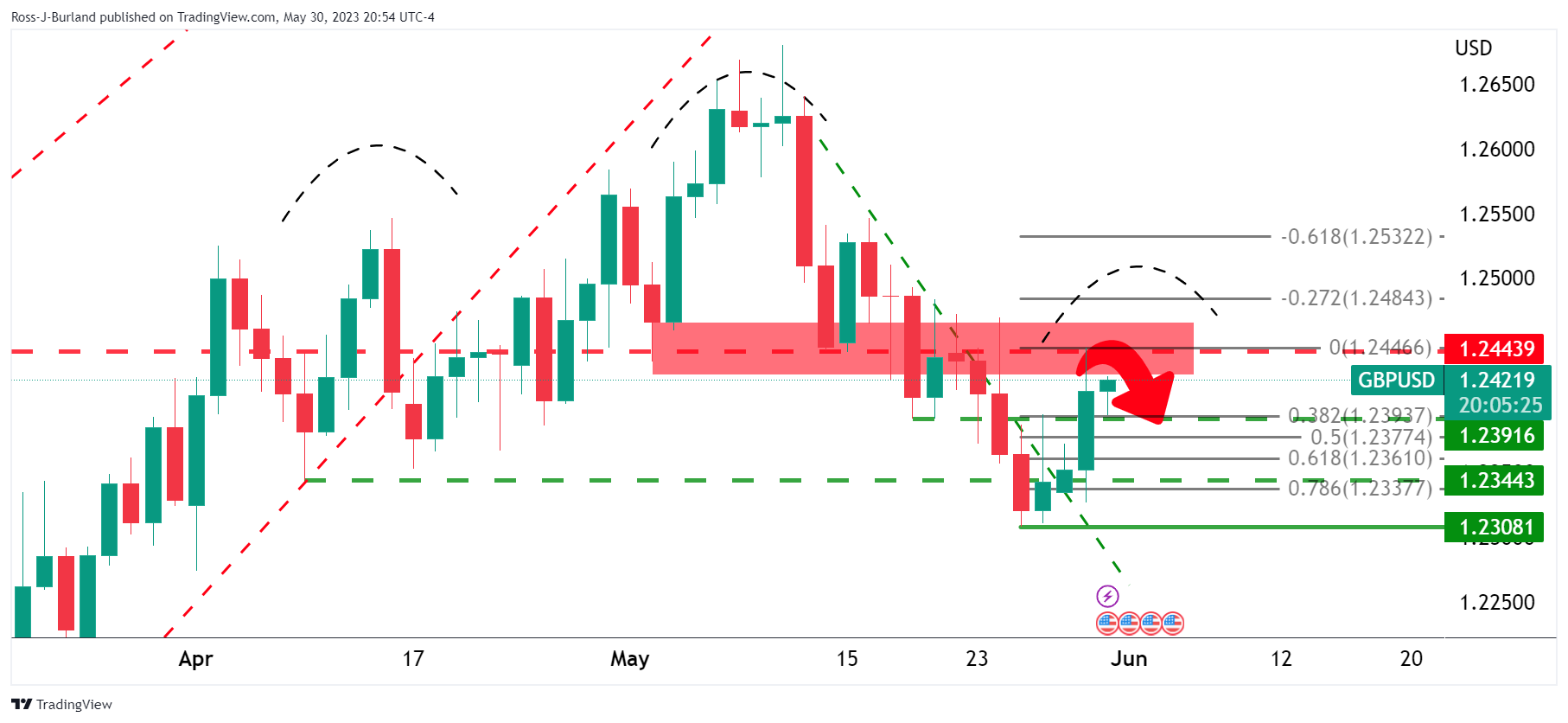

- GBP/USD bears eye 1.2370s and then the trendline support into the congestion towards 1.2350.

- Bulls look for a move to test resistance within the right-hand shoulder.

GBP/USD bulls are stepping in at support and eye an upside continuation to test daily resistance again. The following illustrates a scenario whereby we could see a shorter-term bearish correction playout before the next bullish impulse.

GBP/USD daily charts

The price is sideways with a bearish bias in the main, longer-term.

The right-hand side shoulder´s bullish thrust was strong and this signifies that there could be more upside to come. This can be read as follows on the four-hour chart:

GBP/USD H4 chart

The price has rallied into a high-volume candle and has met resistance. This leaves the meanwhile focus on a correction into the 1.2370s and then the trendline support into the congestion towards 1.2350. Bulls could be encouraged to reengage at a discount and this could be the fuel for the next bullish impulse for a higher high within the right-hand shoulder.