WTI challenges $55.00 post-EIA

- US inventories unexpectedly rose last week.

- WTI weaker, tests the $55.00 handle.

- Doubts remain on potential extension of OPEC deal.

Prices of the barrel of the American reference for the sweet light crude oil are trading on the defensive on Wednesday, currently putting the $55.00 mark under pressure following the EIA’s weekly report.

WTI offered post-EIA

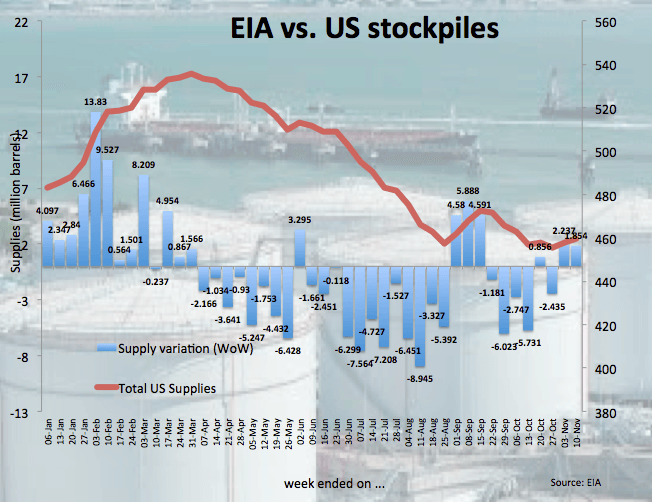

Prices for the WTI are holding on to the $55.00 neighbourhood after US crude oil supplies unexpectedly rose by 1.854 million barrels during the week ended on November 10 vs. a forecasted draw of 2.2 million barrels.

Additionally, weekly distillates stocks dropped by 0.799 million barrels and gasoline stockpiles went up by 0.894 million barrels.

Furthermore, supplies at Cushing decreased by 1.504 million barrels.

Prices for the black gold retreat more than 1% today after optimism over a potential extension of the ongoing OPEC production cut agreement seems to have ebbed somewhat following doubts from Russia, which still deems premature any decision on the deal.

It is worth mentioning that the OPEC will meet in Vienna on November 30 and traders expect the cartel to make a decision on the matter.

In addition, the latest IEA report suggested US shale production is expected to keep growing, adding that the US will lead the oil and gas markets in the coming decades. Further out, the Paris-based agency trimmed its forecasts for oil demand for the current year and 2018 to 1.5 mbpd and 1.3 mbpd, respectively.

WTI significant levels

At the moment the barrel of WTI is down 0.65% at $55.34 and a breach of $54.54 (38.2% Fibo of $45.58-$57.69) would aim for $54.44 (21-day sma) and then $53.51 (50% Fibo of $45.58-$57.69). On the upside, the immediate resistance aligns at $56.26 (10-day sma) followed by $57.91 (2017 high Nov.8) and finally $62.58 (2015 high May 6).