Back

29 Mar 2019

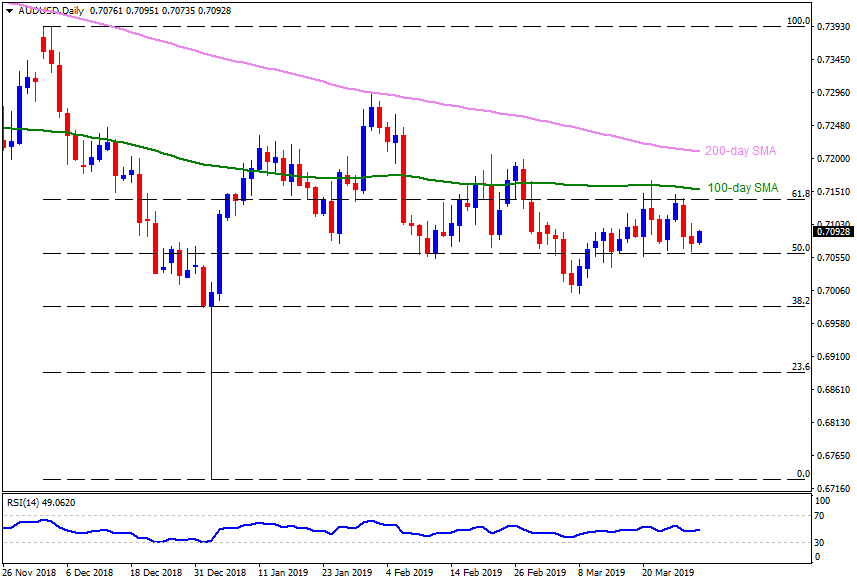

AUD/USD Technical Analysis: Repeated bounces off 50% Fibo. can recall 0.7140 as a quote

- The AUD/USD pair trades near 0.7100 while heading towards Friday’s European session.

- The pair has been falling short to decline beneath 50% Fibonacci retracement of its December 2018 – January 2019 drop, which in turn signal brighter chance of its pullback to 0.7120 immediate resistance.

- Should prices manage to clear 0.7120, 61.8% Fibonacci retracement level of 0.7140 and 0.7160 comprising 100-day simple moving average (SMA) could gain market attention.

- Additionally, pair’s sustained trading past-0.7160 enables it to aim for 0.7200 mark ahead of targeting the 200-day SMA level of 0.7210.

- On the contrary, pair’s dip beneath 0.7055 nearby support could recall 0.7030 and 0.7000 on the chart.

- However, 38.2% Fibonacci retracement near 0.6980 could limit the pair’s declines under 0.7000, if not then 0.6910 and 0.6830 might come to market’s focus.

AUD/USD daily chart