EUR/JPY technical analysis: Bears await break of 120.80/78 to aim for January low

- EUR/JPY buyers lurk around June month low amid nearly oversold RSI.

- Break of key support can drag prices to sub-120.00 region.

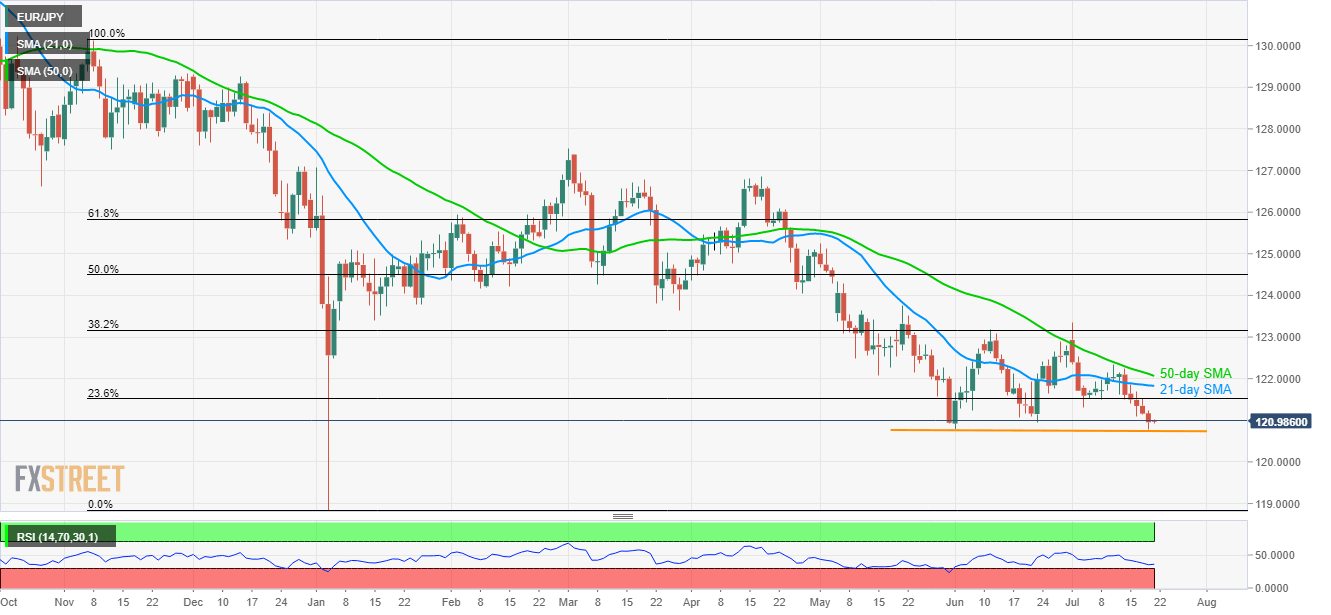

With the failure to slip beneath 120.80/78 support-zone, the EUR/JPY pair trades near 121.00 during early Friday.

Given the nearly oversold conditions of 14-day relative strength index (RSI) and the quote’s U-turn from June month low, prices are likely to witness a pullback towards early-month low close to 131.30 while 23.6% Fibonacci retracement of November 2018 to January 2019 drop, at 121.51, could be on buyers’ radar then after.

Should prices manage to clear 23.6% Fibonacci retracement, 21-day and 50-day simple moving averages (SMAs) around 121.83 and 122.07 respectively could return to the chart.

Alternatively, bears await a sustained break of 120.80/78 support-zone, comprising June month low, to aim for January’s flash crash bottom surrounding 118.85. However, 120.00 round-figure might offer an intermediate halt during the slump.

EUR/JPY daily chart

Trend: Pullback expected