Back

22 Jul 2019

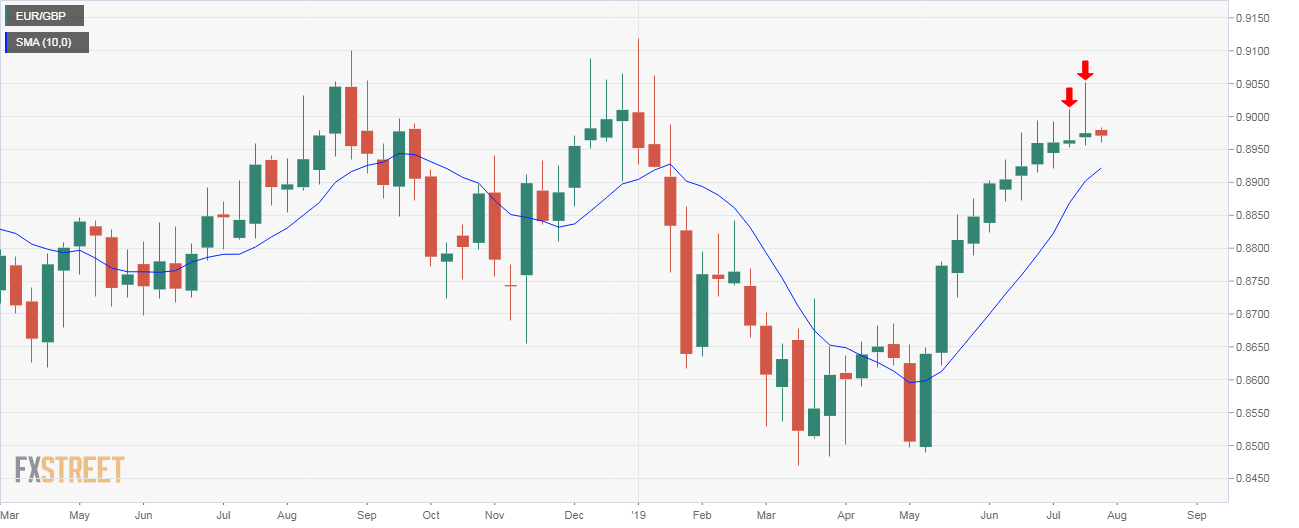

EUR/GBP technical analysis: Bullish exhaustion after 11-week winning run

- Weekly candles indicate buyer exhaustion near 0.90.

- The daily chart shows a bearish MACD divergence.

The EUR/GBP bulls are looking exhausted, having engineered an 11-week winning run, and the pair could drop to the 10-week moving average (MA) at 0.8917 in the next couple of days.

The multiple candles with long upper wicks seen on the weekly chart indicate buyer exhaustion around 0.90.

Further, the daily chart shows a bearish divergence of the moving average convergence divergence (MACD) histogram. The indicator has printed negative (bearish) readings over the last month, contradicting the higher lows on the spot.

Put simply, the odds appear stacked in favor of a pullback to the ascending 10-week MA, currently at 0.8917.

As of writing, the pair is trading at 0.8970, having hit a low of 0.8955 earlier today.

Weekly chart

Daily chart

-636993619899572528.png)

Trend: Bearish

Pivot points