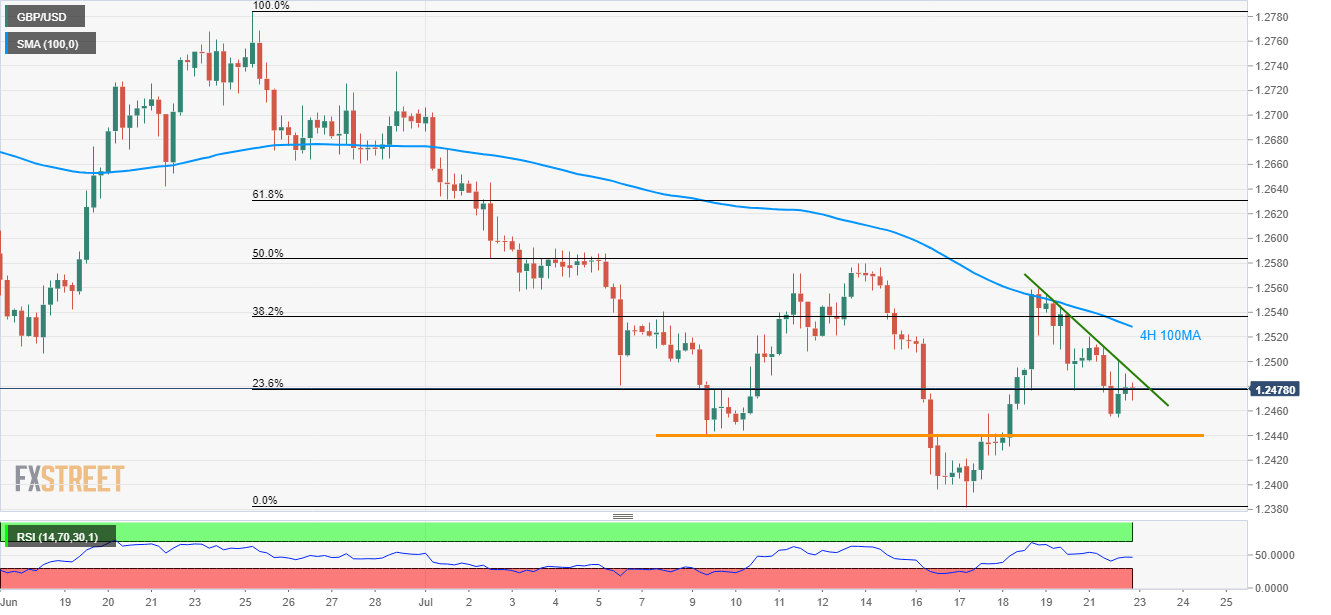

GBP/USD technical analysis: Sellers target 1.2440 as 4H 100MA limits immediate upside

- 3-day long descending trend-line, sustained trading below key short-term moving average portray GBP/USD weakness.

- Bears can aim for 1.2382 if 1.2440 fail to disappoint them.

Following its sustained downpour below the key short-term moving average and a downward sloping trend-line, the GBP/USD declines to 1.2480 during the early Asian session on Tuesday.

The pair now aims to revisit the 1.2440 horizontal support comprising early-month lows and mid-month highs, a break of which can push sellers towards the monthly bottom around 1.2382.

In a case bears dominate past-1.2382, April 2017 low near 1.2365, followed by 1.2300 round-figure, will be on their radar.

Meanwhile, an upside clearance of immediate trend-line resistance, at 1.2491 now, can propel the pair to 100-bar moving average on the 4-hour chart (4H 100MA) close to 1.2530.

Additionally, pair’s successful run-up beyond 1.2530 enables it to claim mid-month tops surrounding 1.2580.

GBP/USD 4-hour chart

Trend: Bearish