Back

5 Aug 2019

EUR/USD technical analysis: Euro clings to daily highs ahead of ISM Non-Manufacturing PMI

- EUR/USD is approaching 1.1200 as the US Dollar is weighed down by the US-China trade war.

- The level to beat for bulls are seen at the 1.1180, 1.1120 and 1.1255 levels.

ISM Non-Manufacturing PMI may disappoint and weigh on the dollar – FXStreet Surprise Index

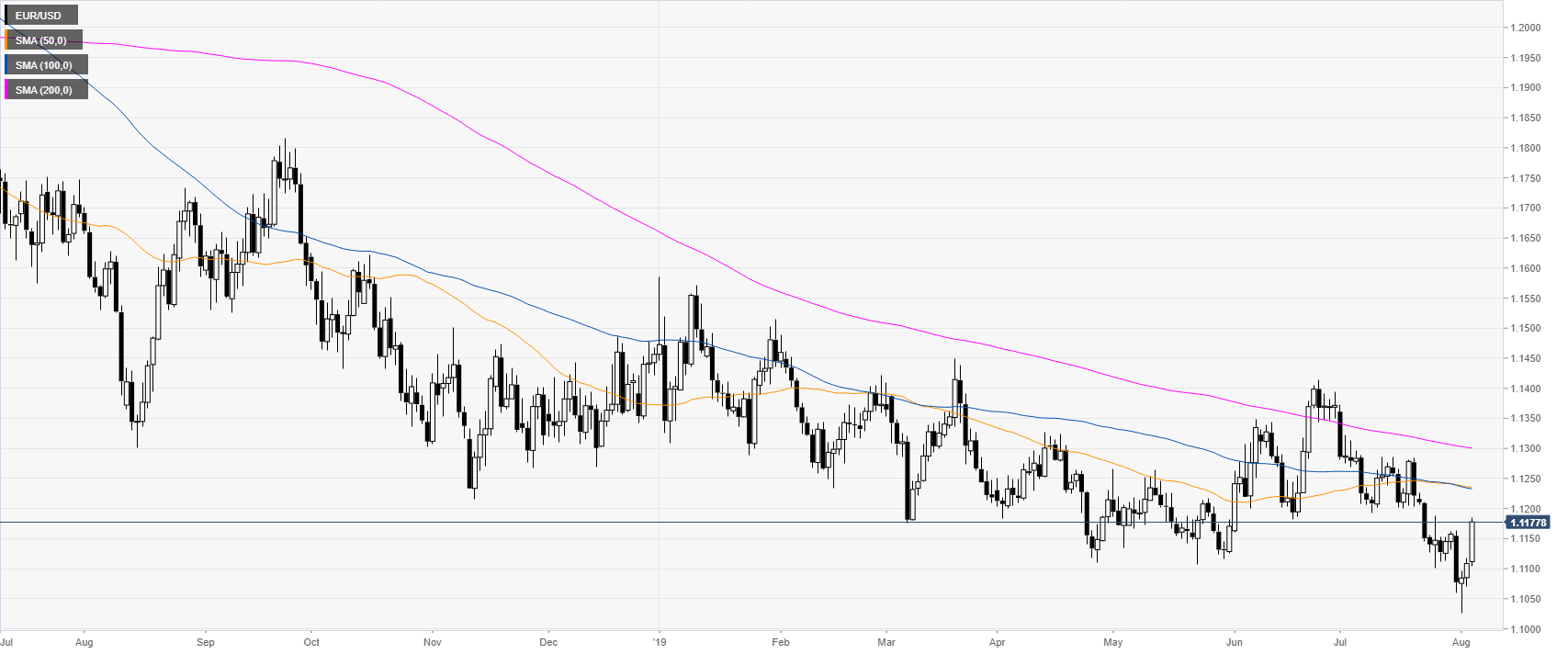

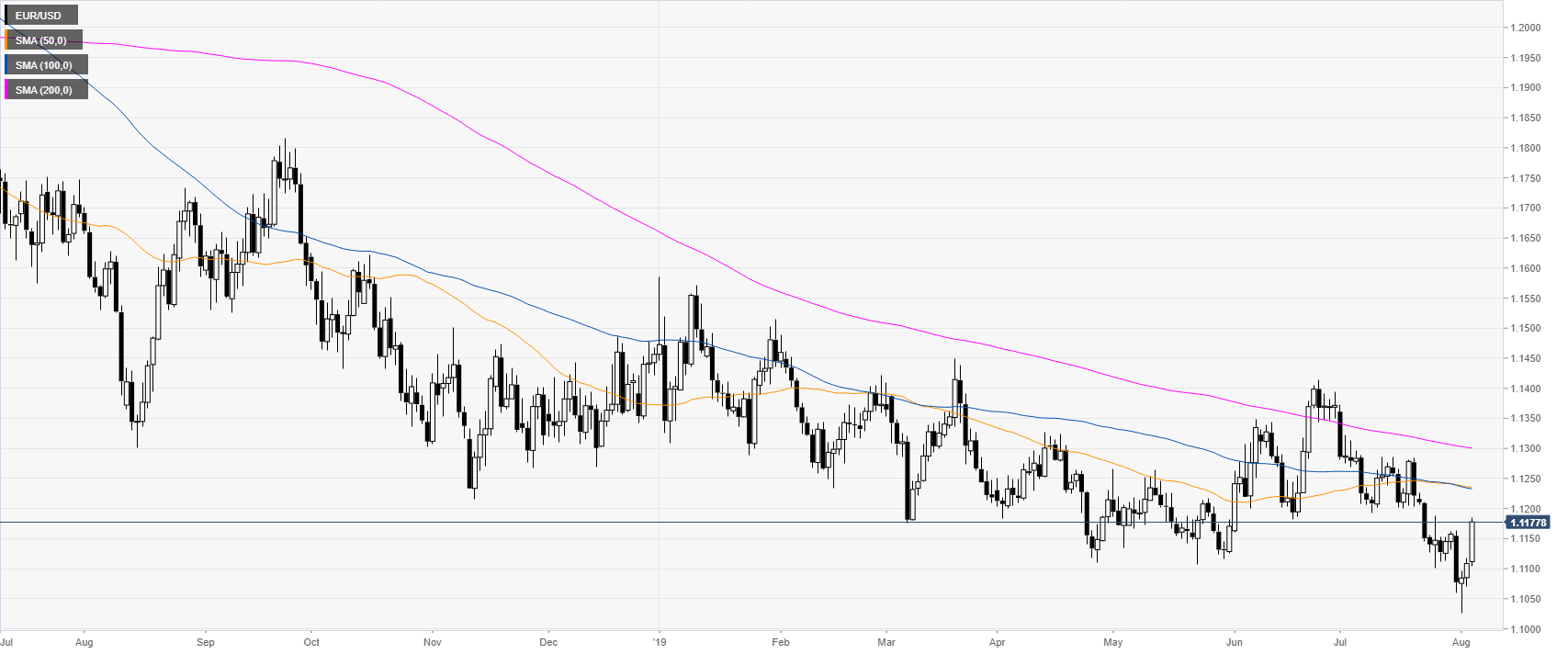

EUR/USD daily chart

EUR/USD is having a recovery from the 2019 low as the market is trading in a bear trend below its main daily simple moving averages (DSMAs). The US-China trade war is weighing on the greenback. Also, US stock markets are down while investors seek refuge in government bonds, sending US bond yields to multi-year lows.

EUR/USD 4-hour chart

EUR/USD is challenging the 1.1180 as the market accelerated above the 50 and 100 SMA this Monday. Bulls likely intend to continue to drive the market higher towards 1.1120 and 1.1255 resistances, according to the Technical Confluences Indicator.

EUR/USD 30-minute chart

The market is challenging the highest point in seven days while above its main SMAs suggesting bullish momentum in the near term. Support might emerge near 1.1138, 1.1121 and 1.1100 levels.

Additional key levels