Back

30 Oct 2019

AUD/USD technical analysis: Aussie holding at October highs ahead of the Fed

- The Aussie is trading near daily highs ahead do the all-important Fed’s decision at 18:00 GMT.

- The level to beat for bulls is the 0.6870 resistance level.

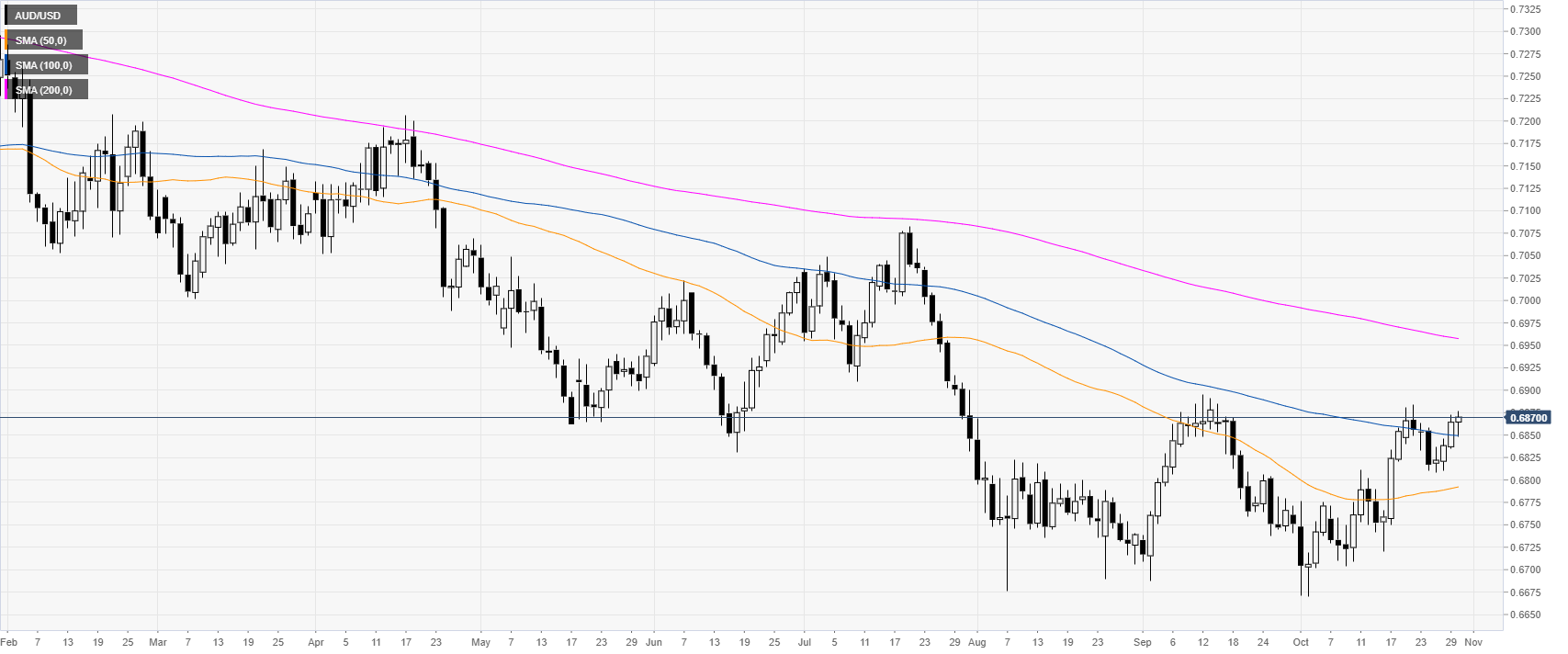

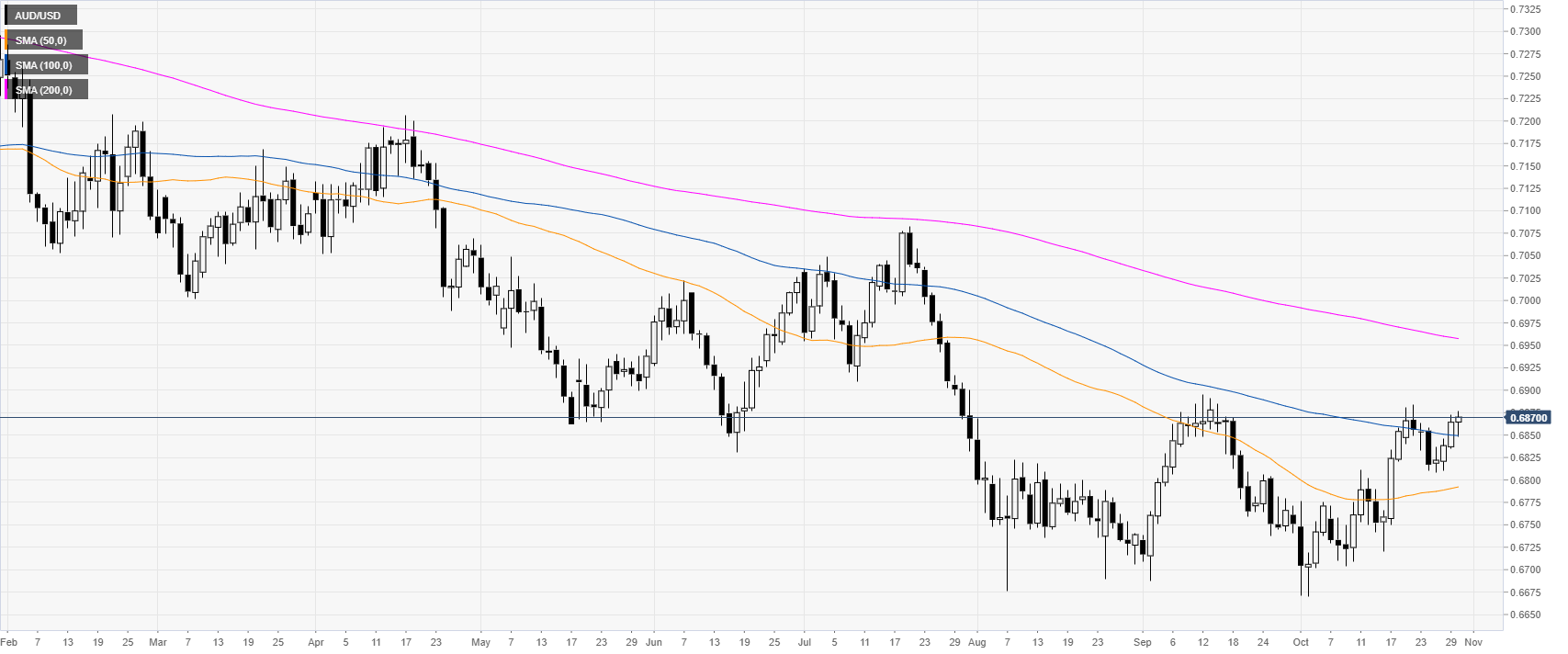

AUD/USD daily chart

The Aussie is trading in a downtrend below its 200-day simple moving averages (DMAs) on the daily chart. The market will take its cues from the Fed’s interest rate decision at 18:00 GMT, which is going to be followed by a press conference.

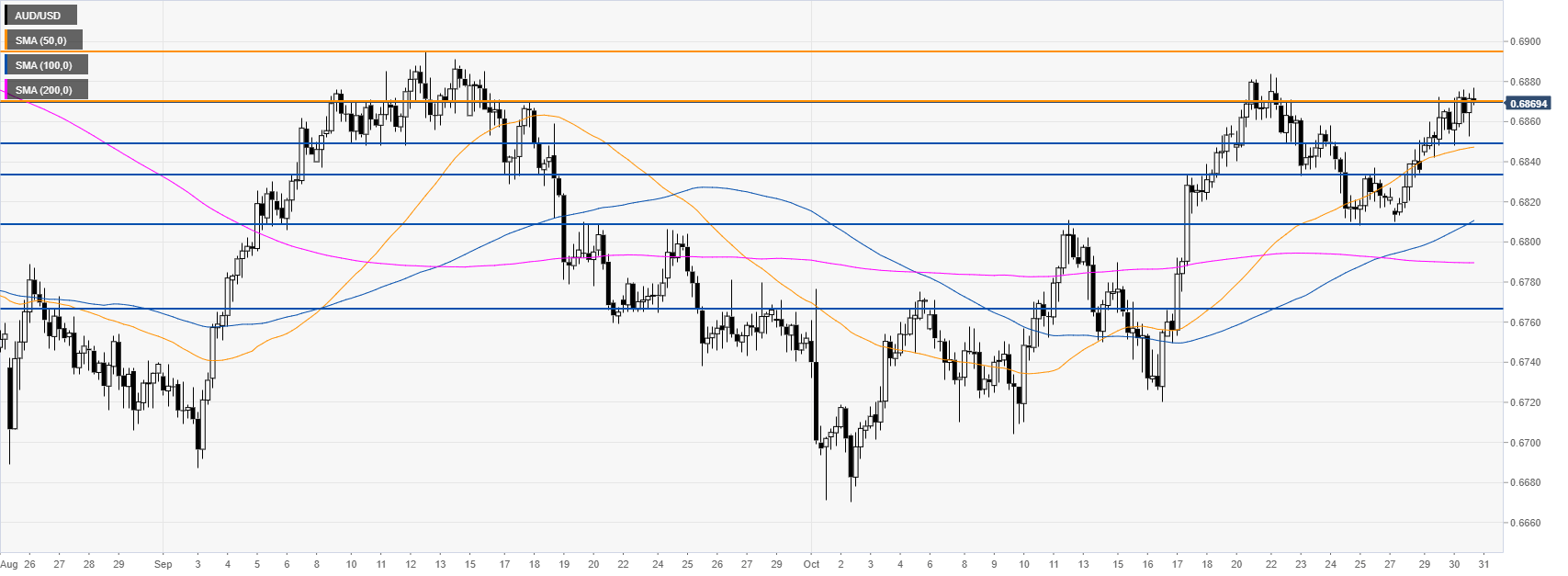

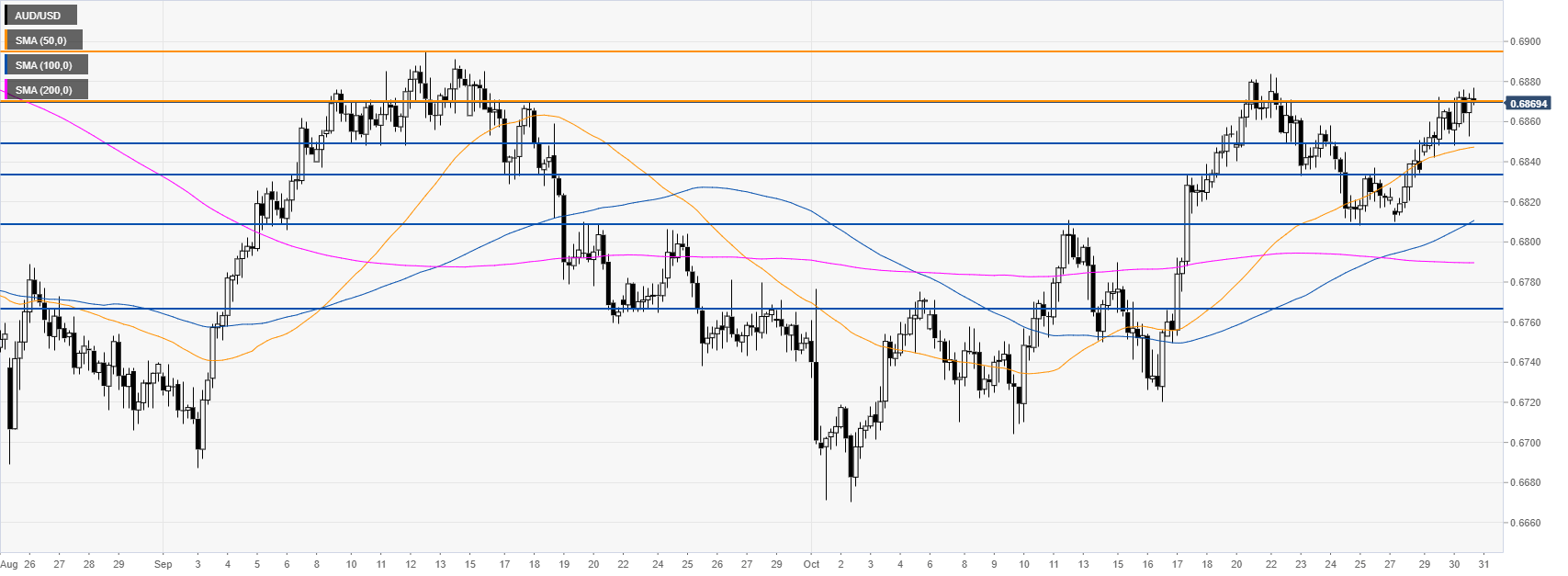

AUD/USD 4-hour chart

The spot is trading above its main SMAs, suggesting bullish momentum in the medium term. However, bulls need to overcome the 0.6870 resistance to reach new October highs near 0.6895 and 0.6950 price levels, according to the Technical Confluences Indicator. Support is seen at the 0.6850, 0.6833, and down to the 0.6809 price level.

Additional key levels