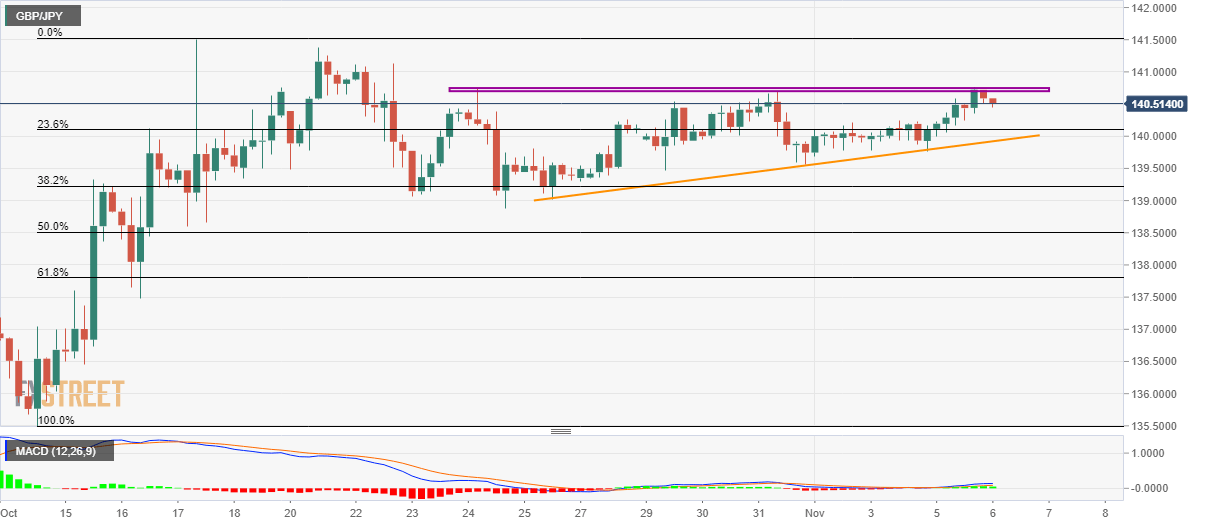

GBP/JPY technical analysis: Registers another pullback from 140.70/75 resistance area

- GBP/JPY steps back from the nearly three-week-old horizontal resistance region.

- A rising triangle seems to restrict the pair’s near-term moves while keeping sellers hopeful.

With it’s another U-turn from the short-term key horizontal resistance, GBP/JPY declines to 140.51 during the Asian session on Wednesday.

Prices are now trading downwards to 23.6% Fibonacci retracement of mid-October upside, at 140.10, prior to visiting 140.00 round-figure. Though, an ascending trend line since October 25, at 139.90, will challenge the pair’s further south-run.

It should, however, be noted that a price weakness below 139.90 seems to call the bears targeting October 24 low near 138.87.

Meanwhile, an upside clearance of 140.70/75 horizontal region will escalate the pair’s recovery towards 141.00 and then the October month high close to 141.50.

During the pair’s further rise beyond 141.50, late-may high surrounding 141.75 will be live on bull’s radar.

GBP/JPY 4-hour chart

Trend: pullback expected