Back

6 Dec 2019

US Dollar Index price analysis: DXY, a recovery we can believe in?

- DXY is boosted by stellar November’s Nonfarm Payrolls (NFP) readings.

- DXY is set to remain under bearish pressure below the 98.00/98.20 price zone.

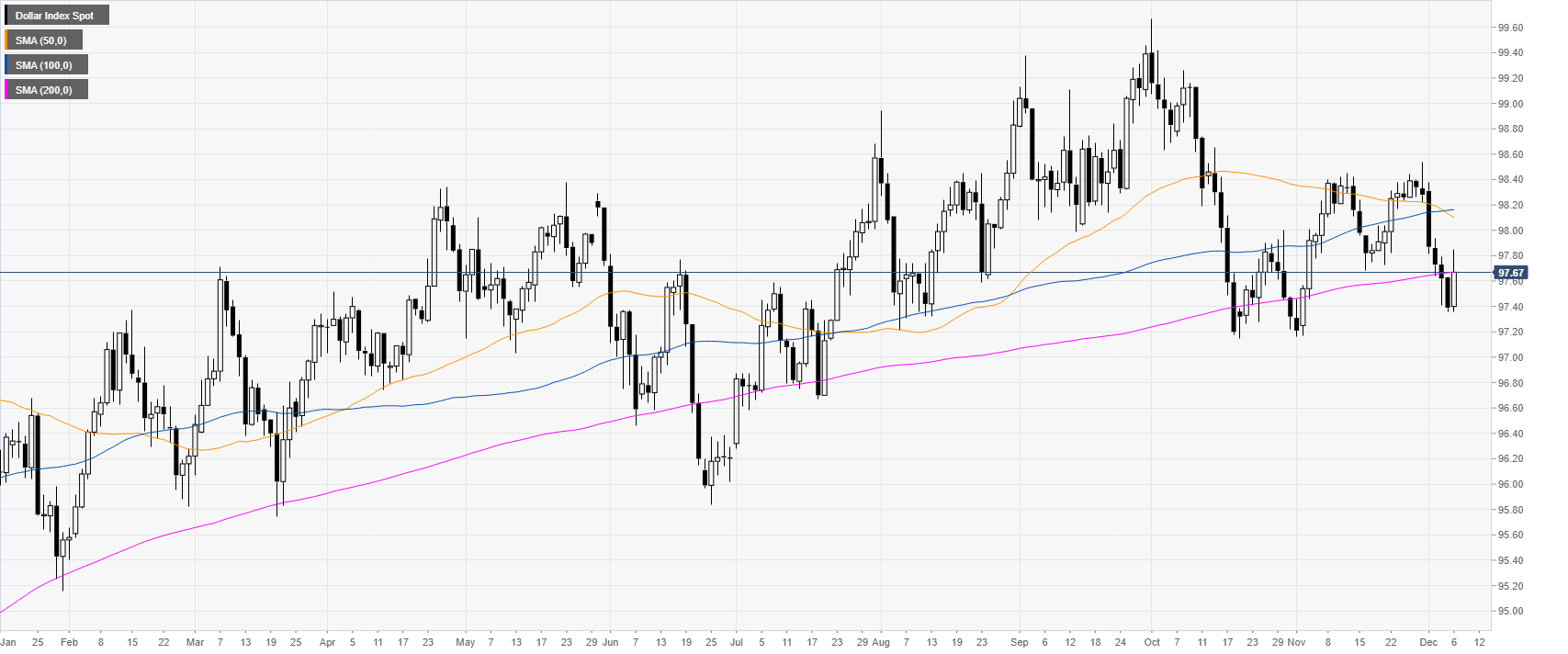

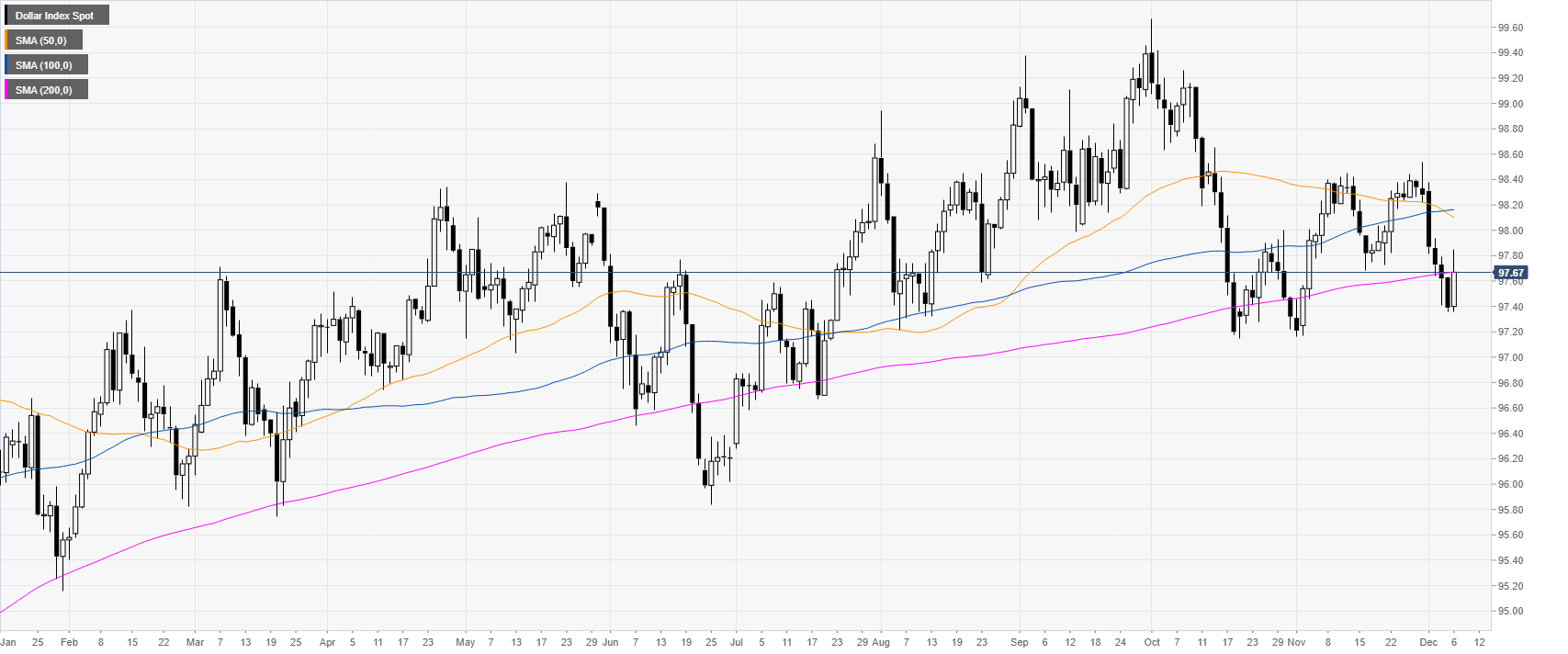

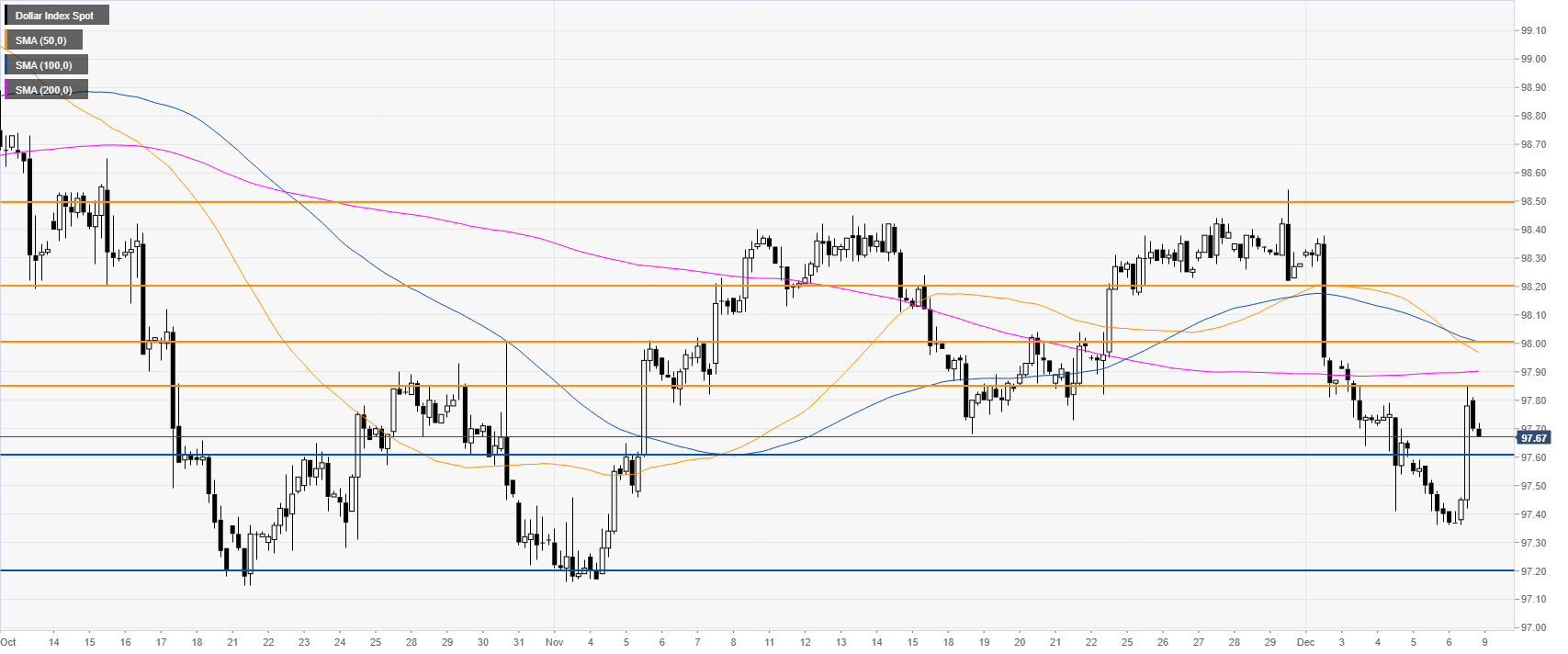

DXY daily chart

DXY (US Dollar Index) is trading in a weak uptrend as the market is struggling to hold near the 200-day simple moving average (DMA).

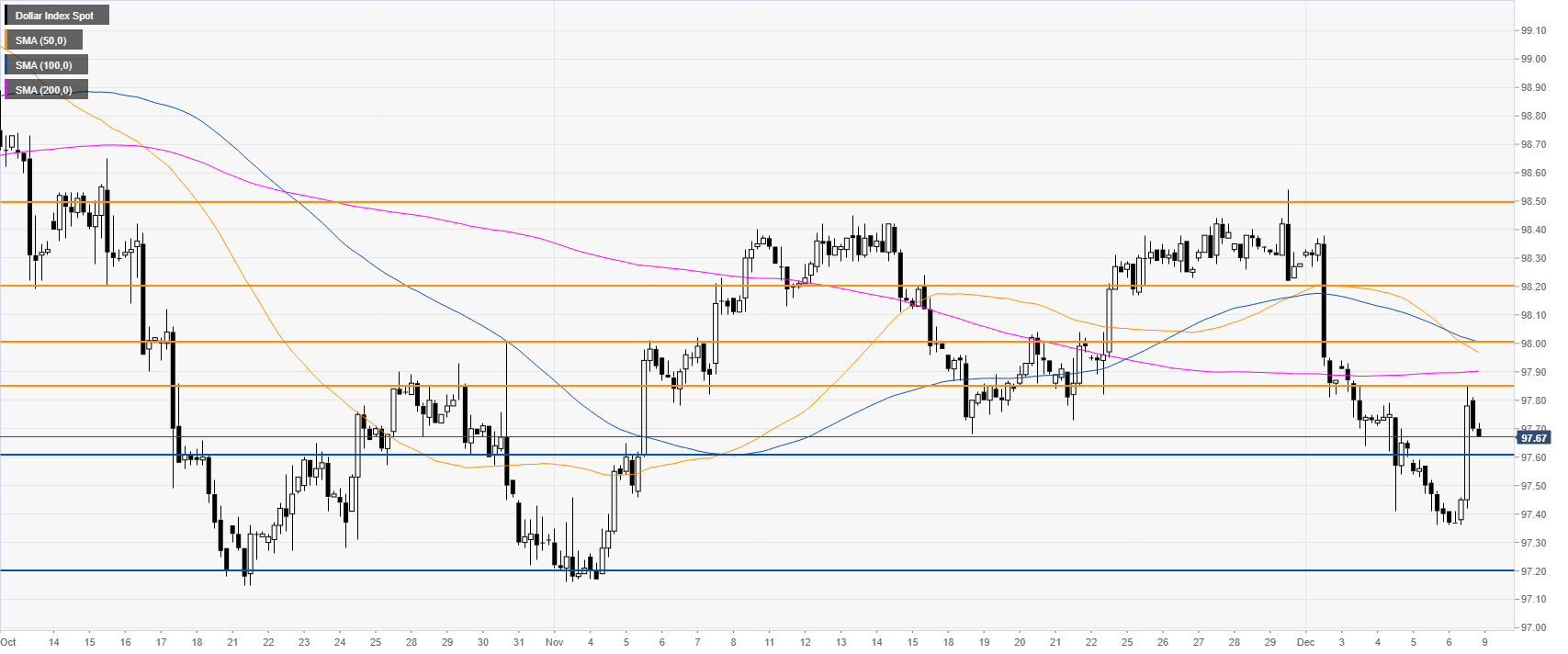

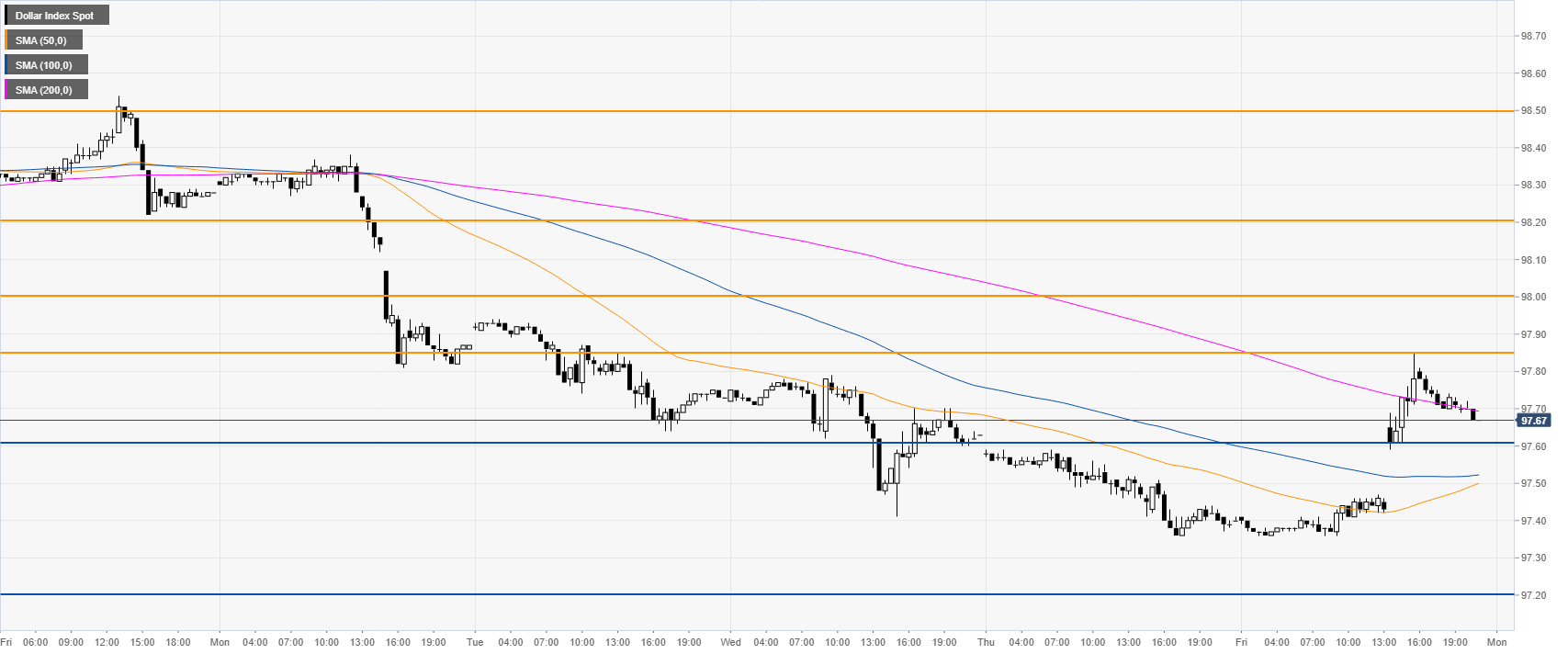

DXY four-hour chart

The stellar November’s Nonfarm Payrolls (NFP) gave a boost to DXY to the 97.85 level while staying below the main SMAs. DXY bulls don’t seem to be out of trouble just yet as the recovery would gain credibility above the 98.00/98.20 price zone.

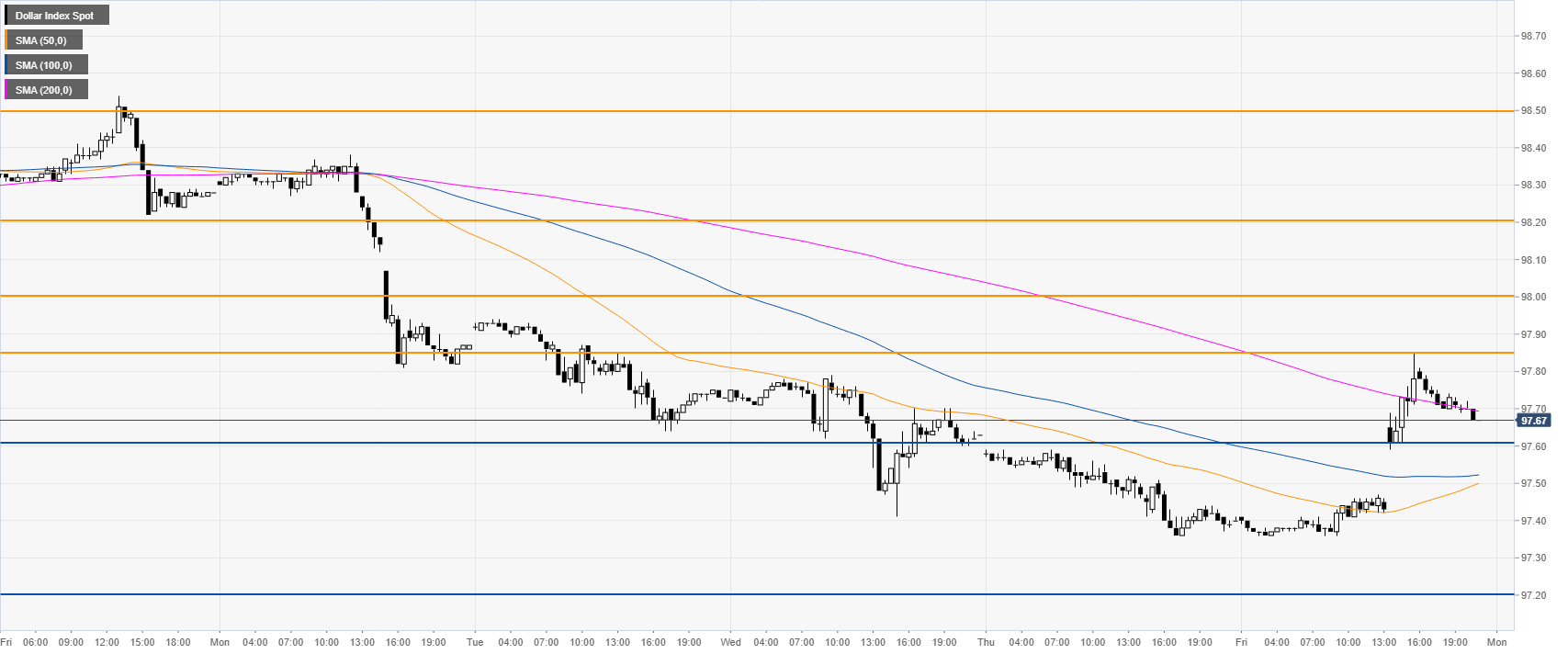

DXY 30-minute chart

The bullish spike is retracing below the downward sloping 200 SMA. If the bears retake the 97.60 support, the index is set to trade down to the 97.20 level.

Additional key levels