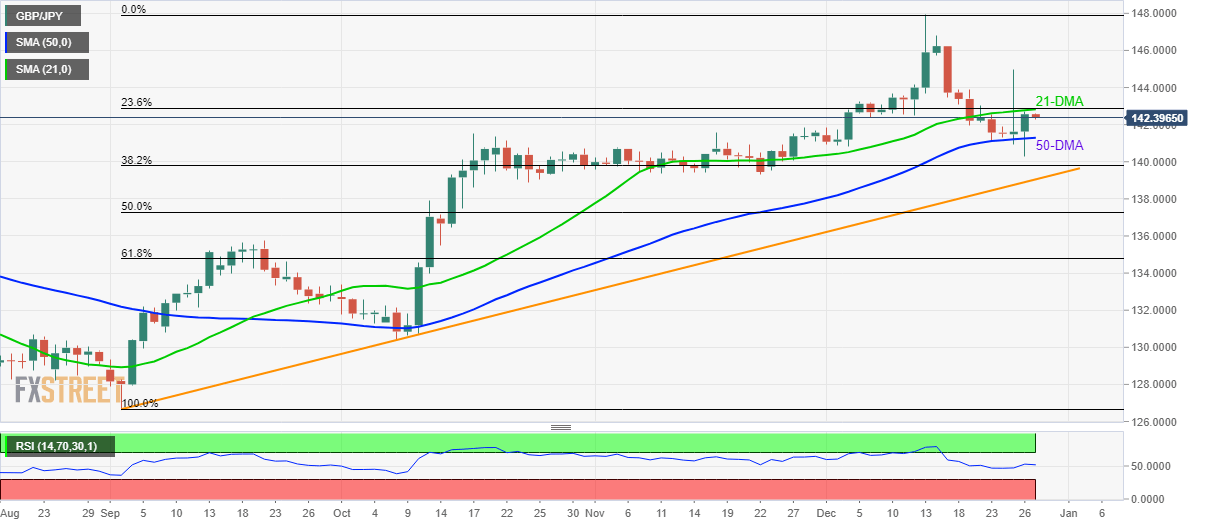

GBP/JPY Technical Analysis: Pulls back from 142.83/90 confluence on Japanese catalysts

- GBP/JPY steps back from 21-DMA, 23.6% Fibonacci retracement after Japan’s data dump, BOJ Summary of Opinions.

- 50-DMA acts as immediate support ahead of the key support trend line.

Given the mostly upbeat prints of Japanese data and Bank of Japan (BOJ) policymakers’ Summary of Opinions, GBP/JPY declines to 142.30 during early Friday.

Read: USD/JPY drops to 109.55 after Japan’s data dump

The pair seems now declining towards a 50-day Simple Moving Average (DMA) level of 141.30 while 38.2% Fibonacci retracement of September-December upside, at 139.80, could question bears then after.

If at all sellers dominate below 139.80, an ascending trend line since early-September, at 139.00 now, will be on the Bears’ radar.

Alternatively, pair’s daily closing beyond the confluence of 21-DMA and 23.6% Fibonacci retracement, near 142.83/90, could escalate the recovery towards 144.00 and December 16 low near 145.75.

Assuming the quote’s extended rise past-145.75, the monthly top surrounding 148.00 could be refreshed.

GBP/JPY daily chart

Trend: Pullback expected