Back

24 Mar 2020

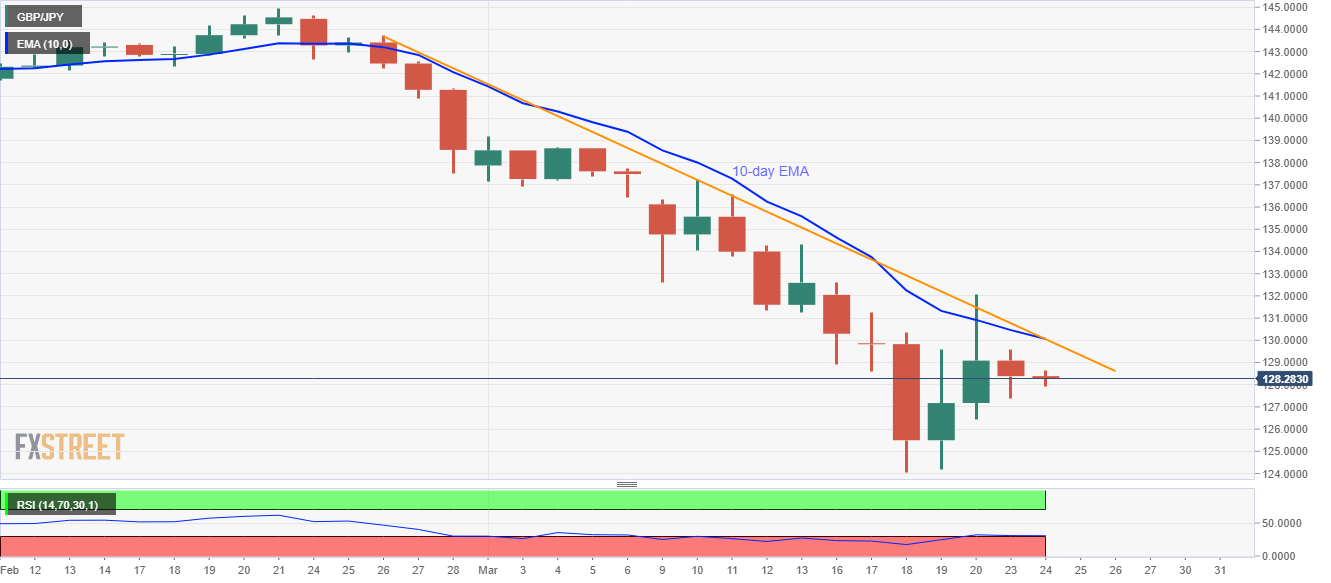

GBP/JPY Price Analysis: Under pressure below 10-day EMA, monthly trendline

- GBP/JPY remains on the back foot below near-term key resistance confluence.

- The monthly low becomes the key.

- An upside break of the resistance confluence can challenge the monthly top.

GBP/JPY declines to 128.00, down 0.16%, amid the initial Tokyo trading on Tuesday. In doing so, the pair extends its pullback moves below 10-day EMA and a downward sloping trend line stretched from February 26.

That said, sellers can now aim for 127.00 before targeting the monthly low near 124.00.

However, oversold RSI conditions seem to question the bears and could restrict the further downside.

On the contrary, the pair’s successful break above the 130.00-10 resistance confluence might not hesitate to challenge the early-month tops near 139.00.

Though, 132.50-60 can act as an intermediate halt during the recovery moves.

GBP/JPY daily chart

Trend: Pullback expected