USD/CAD Price Analysis: Bearish MACD keep sellers hopeful

- USD/CAD fails to hold onto recovery gains, drops to the immediate support line.

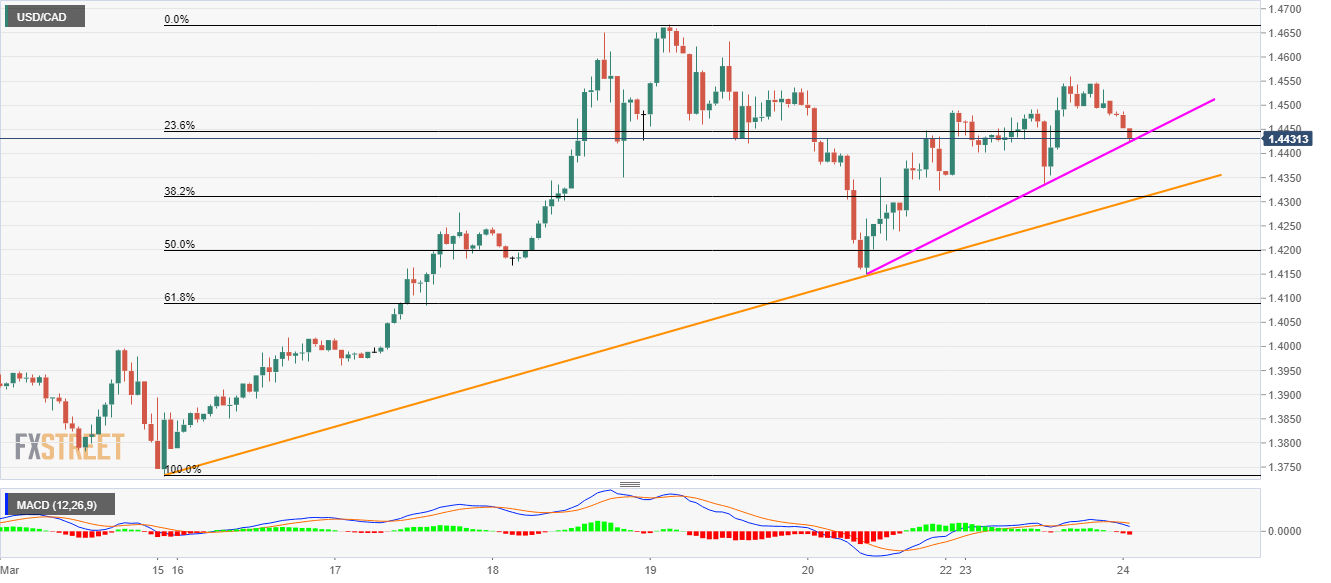

- A confluence of the weekly rising trend line and 38.2% Fibonacci retracement could challenge the bears afterward.

- The bulls will need to defy the last weeks Doji formation to regain command.

USD/CAD drops to the immediate rising support line, down 0.41% to 1.4435, amid the early Tuesday’s trading session. The pair fails to hold onto the previous day’s recovery gains while bearish MACD favors further declines.

As a result, sellers will aim for the weekly ascending trend line and 38.2% Fibonacci retracement of its March 15-19 upside, around 1.4300 during the sustained break below 1.4420 immediate support.

Should there be a clear downside past-1.4300, the pair becomes vulnerable to revisit Friday’s low near 1.4200 and 61.8% Fibonacci retracement around 1.4090.

On the upside, buyers can target 1.4670 on the successful break above 1.4550. However, the pair’s extended rise past-1.4670 will defy the latest Doji formation at the multi-month top and could escalate the run-up towards 1.4800 mark.

USD/CAD hourly chart

Trend: Pullback expected