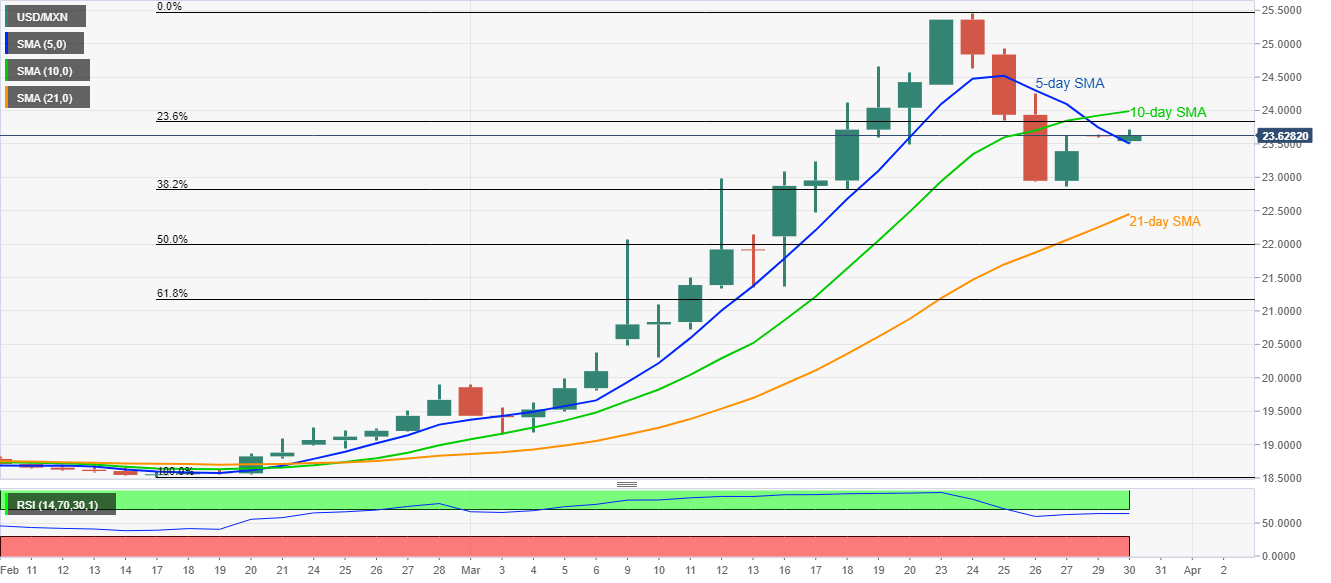

USD/MXN Price Analysis: Mexican peso extends losses, 24.00 in focus

- USD/MXN holds onto recovery gains beyond 5-day SMA.

- 23.6% Fibonacci retracement, 10-day SMA can question buyers.

- 21-day SMA adds to the support below the recent low.

While clearing 5-day SMA, USD/MXN rises to 23.83, up 1.0%, amid the Asian session on Monday.

The pair currently aims to confront 23.6% Fibonacci retracement of its February-March upside, at 23.81. However, the buyers’ major attention will be on the 10-day SMA level of 24.00.

Although nearly overbought RSI conditions signal another pullback from the near-term key resistance, a sustained move beyond 24.00 enables the bulls to target 24.65 and the latest high surrounding 25.45.

On the downside, the pair’s declines below 5-day SMA level of 23.50 can recall the support near 23.80 comprising 38.2% Fibonacci retracement.

However, 21-day SMA close to 22.45 will restrict the quote’s additional south-run past-23.50, if not then the mid-month lows near 21.30 could gain the bears’ attention.

USD/MXN forecast chart

Trend: Bullish