Back

8 Apr 2020

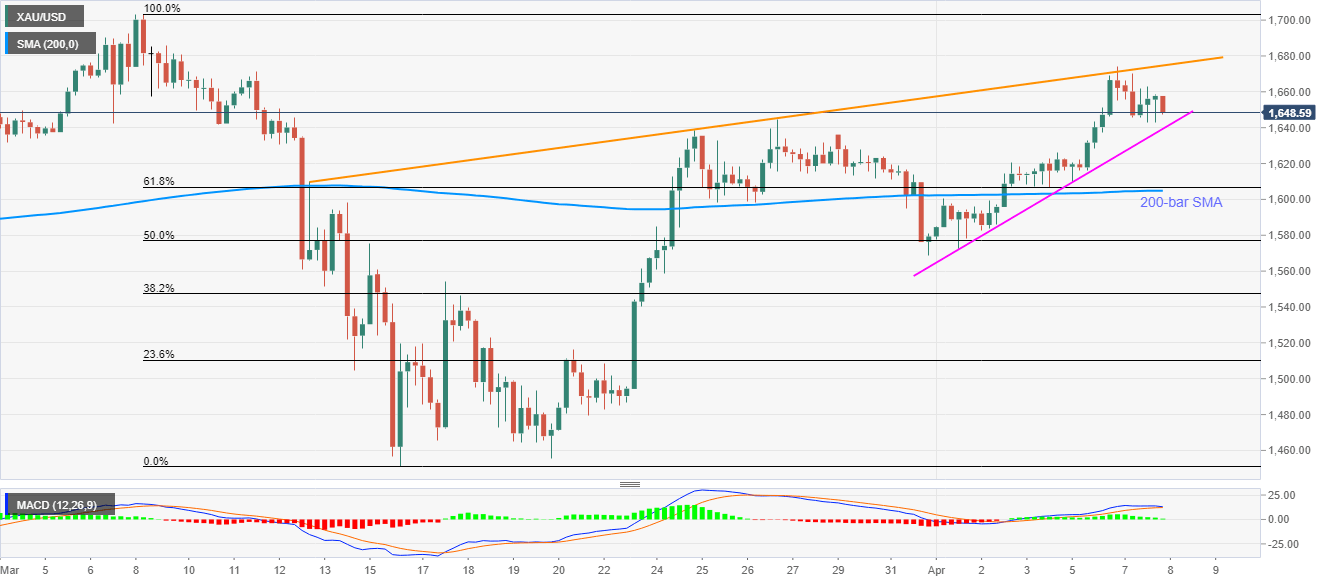

Gold Price Analysis: Drops from four-week-old rising trendline to sub-$1,650 zone

- Gold steps back from the short-term resistance line.

- A one-week-old support line in the immediate focus of the sellers.

- 200-bar SMA, 61.8% Fibonacci retracement offers strong support.

- An upside break of resistance trend line could question March high beyond $1,700.

Gold prices take a U-turn from the near-term resistance trend line, stretched from March 12, while declining to $1,648 during the early Asian session on Wednesday.

With the MACD also teasing bears, the bullion may drop further towards re-testing the immediate support line, around $1,639.

Though, the metal’s additional weakness past-$1,639 could be restricted by 61.8% Fibonacci retracement of March month declines and 200-bar SMA around $1,605/07.

Alternatively, a clear break beyond $1,675 resistance line could renew buying strength towards challenging the previous month high near $1,703.

Gold four-hour chart

Trend: Pullback expected