EUR/USD Price Analysis: Buyers probe three-week-old resistance line near 1.1200

- EUR/USD takes the bids near the highest in 11 weeks.

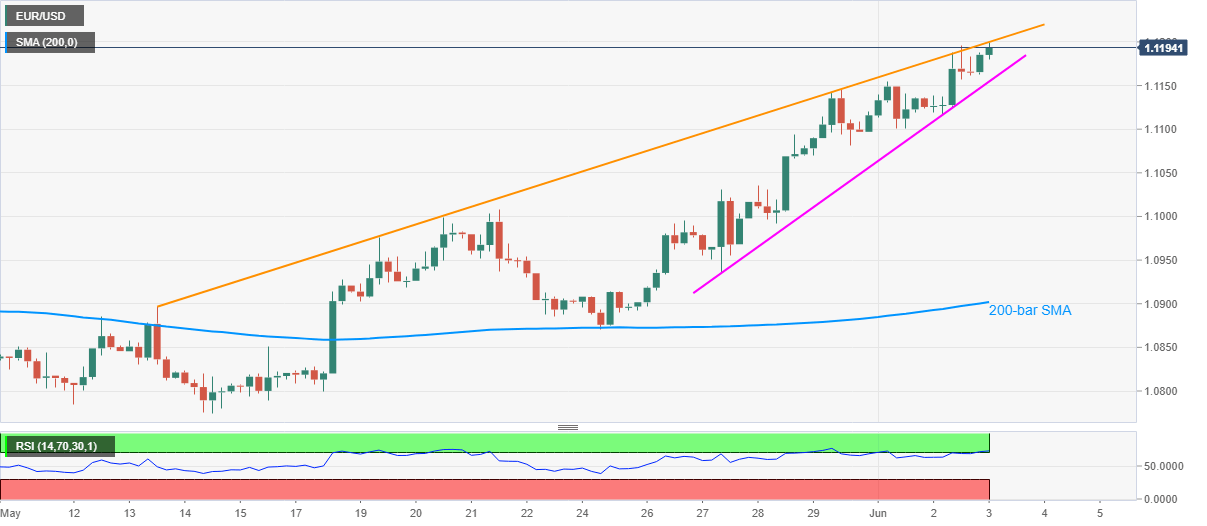

- Overbought RSI, near-term key resistance line might trigger the pair’s pullback.

- The downside break of the weekly support line highlights 1.1000 rest-point.

- Mid-march tops lure the bulls during the further upside.

EUR/USD rises to 1.1197, up 0.25% on a day, amid the Asian session on Wednesday. That said, the pair trades near the highest levels since March 16, while also crossing the previous day’s top near 1.1196, amid overbought conditions.

As a result, odds of the quote’s pullback from an ascending trend line stretched from May 13, at 1.1200, seem brighter.

However, a sustained north run beyond 1.1200 will propel the quote further towards the mid-March top near 1.1237.

On the downside, a short-term support line around 1.1155 could challenge the pullback moves, a break of which might not hesitate to revisit May 21 top near 1.1000.

Additionally, a 200-bar SMA level of 1.0900 can please the bears during the pair’s downside past-1.1000.

EUR/USD four-hour chart

Trend: Pullback expected