Back

30 Jun 2020

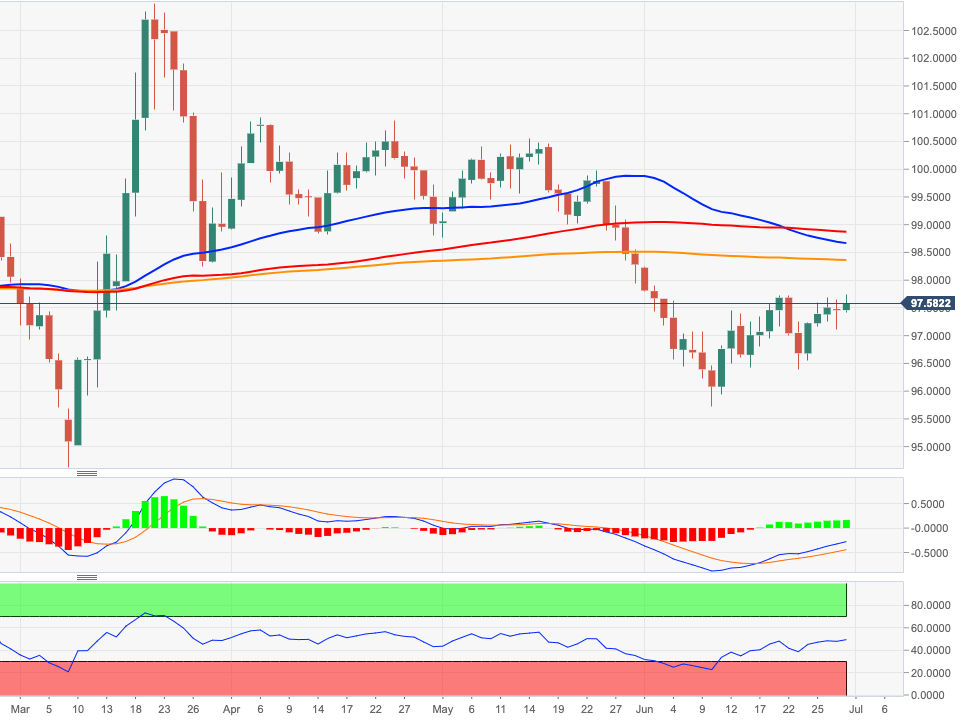

US Dollar Index Price Analysis: Stays bearish below the 200-day SMA

- DXY has managed to test the upper end of the range near 97.80 .

- Above this area aligns the key 200-day SMA at 98.35.

DXY has resumed the upside and appears ready to challenge the upper end of the recent range near 97.80.

If bulls regain the upper hand, the next target of relevance will emerge at the area of 97.90, where coincide monthly peaks and a Fibo retracement (of the 2017-2018 drop).

As long as the 200-day SMA, today at 98.35, caps the upside, further losses are still on the table for the dollar.

DXY daily chart

\

\