The VIX rises over 5% after more volatility in the indices

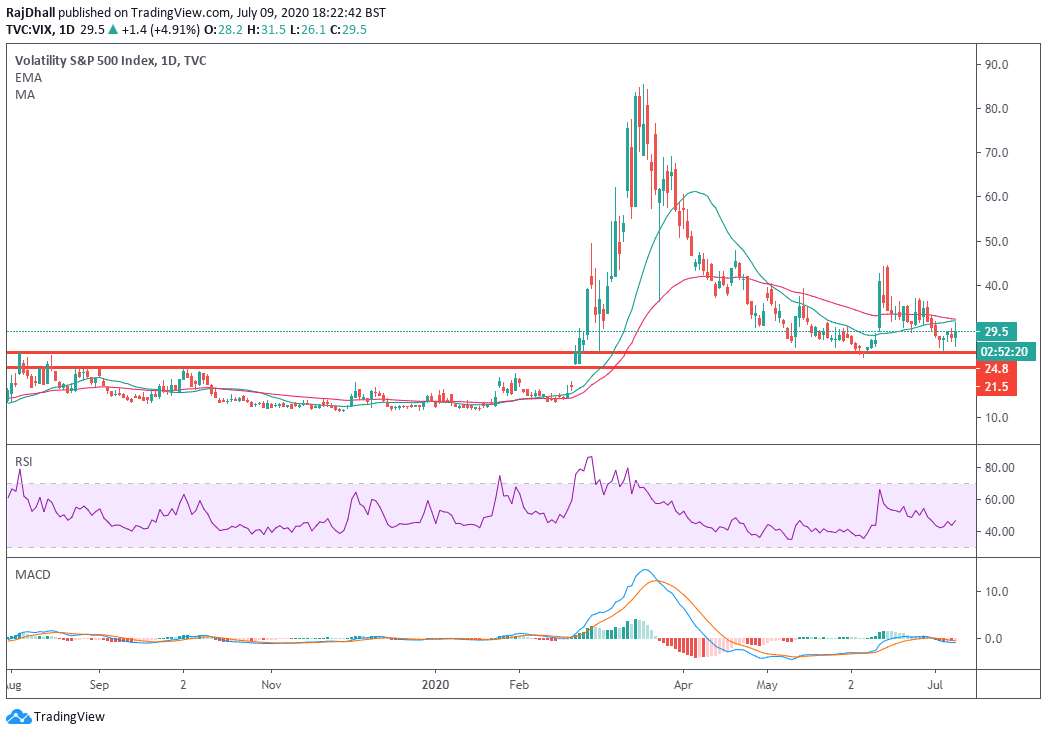

- The VIX is trading 5.34% higher and tested 30 again as volatility increases on Thursday.

- The price has been stopped by the 200 Simple Moving Average once again.

Fundamental backdrop

The news that Donald Trump's finances will be scrutinised was not taken well during the US session. Of course, this is also the election year so if the US President has any skeletons in his closet this could be very damaging. Adding to this, the backdrop of increasing coronavirus cases seems to have tipped the indices over the edge. Just yesterday the market noted another record day for the number of cases recorded.

Data today showed 1.31 million US citizens filed for state unemployment benefits in the latest week, down from 1.43 million in the previous week. Looking closer at the S&P 500 and CBOE are in the bottom three for the third day running but Mohawk Industries are the worst performer, down 20%. The company is facing a lawsuit over financial misconduct but today the losses accelerated as some analysts noted it could take months to find a resolution. On the upside, F5 Networks are at the top of the leaderboard after an upgrade by Morgan Stanley.

VIX daily chart

The VIX chart below shows that it has been another day of volatility. The price has risen over 5% in recent trade as the S&P struggles. The saving grace has been the 200 Simple Moving Average as it has provided the market with some resistance. Also, the 30 psychological level has been working as a resistance too.

On the downside, the key levels are marked by the two red horizontal support lines. The first one is the consolidation high from August 2019. It was then the equities markets were much calmer in an upward trajectory. The other is around 21.5 and this would send the price back into the historical range were once again the equities markets were in a more steady state.