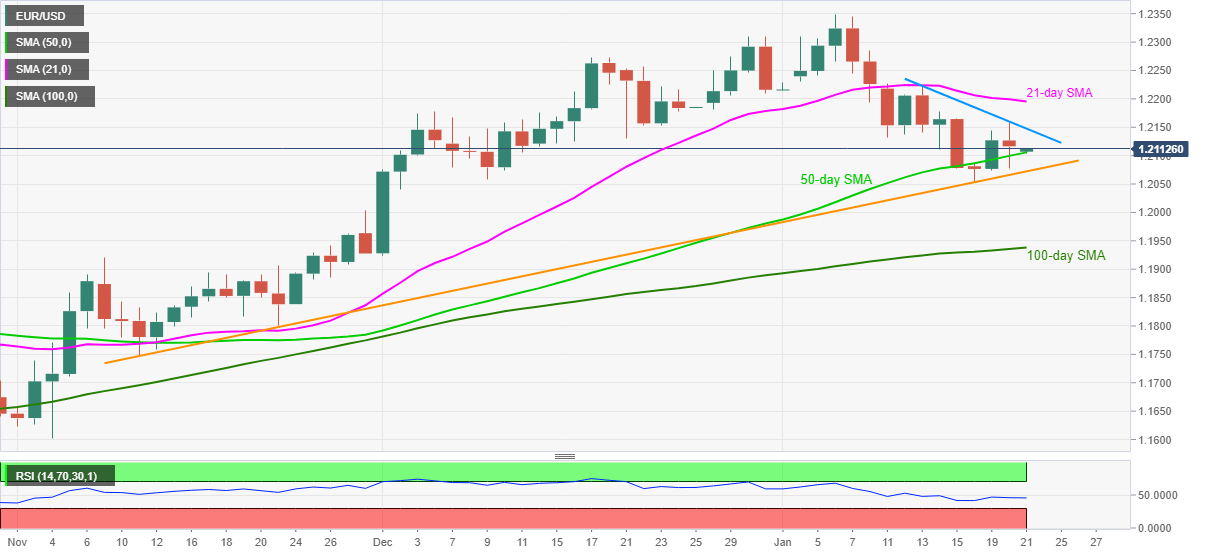

EUR/USD Price Analysis: Extends bounce off 50-day SMA above 1.2100

- EUR/USD stretches recovery moves from 1.2076, refreshes intraday high.

- One-week-old falling trend line lures the bulls, ascending trend line from November 11 adds to the downside filter.

- Upbeat RSI conditions, sustained trading beyond key SMA, support line favor buyers.

EUR/USD takes the bids near 1.2117, the intraday high, amid Thursday’s Asian session. The quote recently jumped as the recently elected US President Joe Biden unveiled the first executive orders. In doing so, the quote keeps the previous day’s U-turn from 50-day SMA.

Read: Joe Biden signs executive action to rejoin Paris Climate Accord “as of today”

Not only the quote’s ability to stay beyond 50-day SMA but successful trading above more than five-month-old rising support line and upbeat RSI conditions also favor EUR/USD bulls.

As a result, a downward sloping trend line from January 13, at 1.2148 now, gains the intraday buyers’ attention. However, 21-day SMA near 1.2195 and the 1.2200 threshold will restrict further EUR/USD upside.

Should the stated north-run jumps past-1.2200, the multi-month high flashed during the month near 1.2350 will be in the spotlight.

Alternatively, a downside break of 50-day SMA, currently around 1.2100, will eye for the stated support line figures of 1.2072.

However, any further weakness past-1.2072 will make EUR/USD prices vulnerable to revisit the sub-1.2000 area wherein the early-November top surrounding 1.1920 becomes important to watch.

EUR/USD daily chart

Trend: Bullish