AUD/USD Price Analysis: Directs six-week-old resistance breakout towards 0.7800

- AUD/USD stays bid near intraday high, up for third consecutive day.

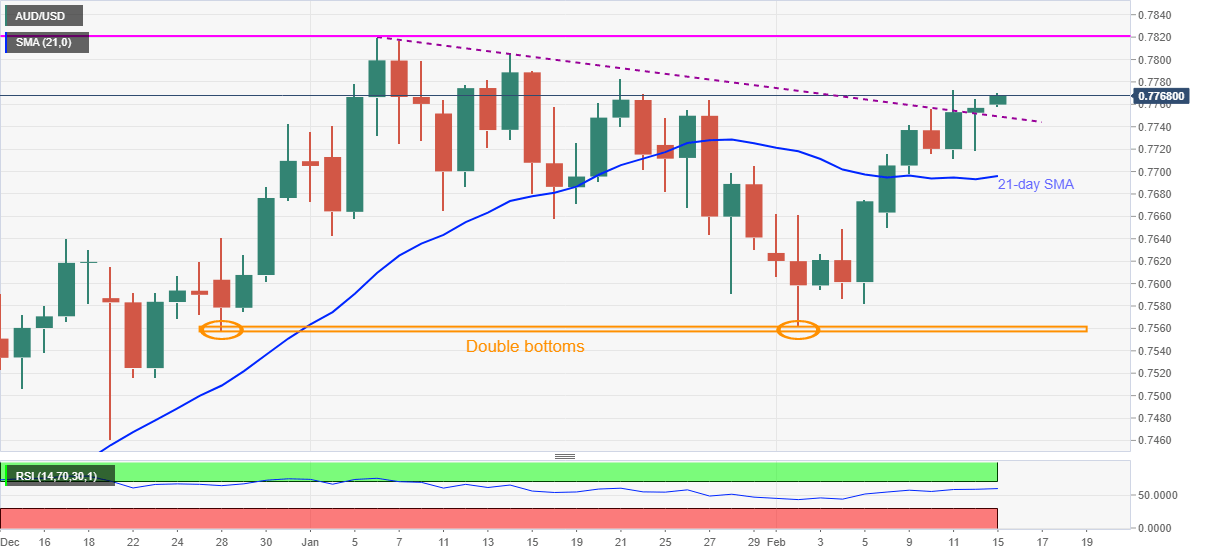

- Strong RSI, not overbought, favors bullish break of previous resistance.

- A fresh yearly high will confirm “double bottom” bullish chart pattern.

AUD/USD takes the bids around 0.7770, up 0.14% intraday, during Monday’s Asian session. Friday’s sustained break above a downward sloping trend line from January 06 favors the Aussie bulls to attack the monthly high.

Also favoring the AUD/USD buyers targeting 0.7775 as an immediate hurdle could be the strong RSI conditions, but not overbought, as well as sustained trading beyond 21-day SMA.

It’s worth mentioning that the quote’s run-up beyond 0.7775 will eye the 0.7800 threshold ahead of targeting January’s high near 0.7820, the key to confirm “doubt bottom” bullish formation. Following that a move beyond the 0.8000 psychological magnet could lure the AUD/USD bulls.

Meanwhile, pullback moves will have to drop below the previous resistance line, at 0.7750 now, before recalling even short-term AUD/USD sellers.

During the further weakness past-0.7750, the 21-day SMA level of 0.7696 will challenge the bears before directing it the “doubt bottoms” marked since December 28, around 0.7555-60.

AUD/USD daily chart

Trend: Bullish