Back

3 Mar 2021

Crude Oil Futures: A deeper pullback is not favoured

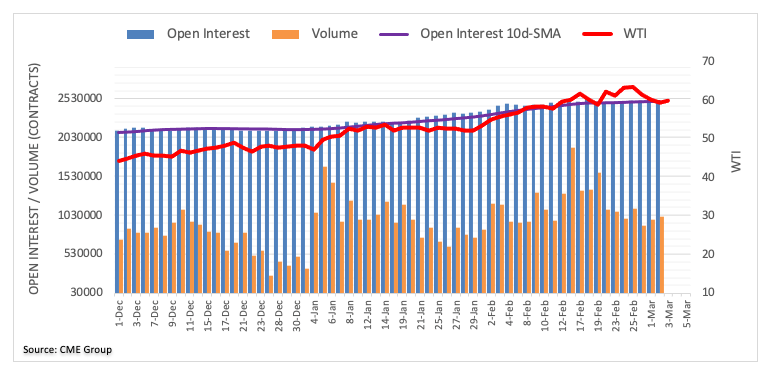

CME Group’s preliminary readings for crude oil futures markets noted open interest went down by nearly 25.5K contracts on Tuesday. On the other direction, volume rose for the second straight session, now by around 46.2K contracts.

WTI focused on 2021 highs and the OPEC+

Prices of the WTI seem to have met some contention in the vicinity of the $59.00 mark for the time being. Tuesday’s pullback was amidst shrinking open interest, indicative that the downside momentum could be waning. Against this, while crude oil price could re-shift the attention to another visit to the 2021 highs near $64.00, a more immediate concern will be the OPEC+ meeting on Thursday.