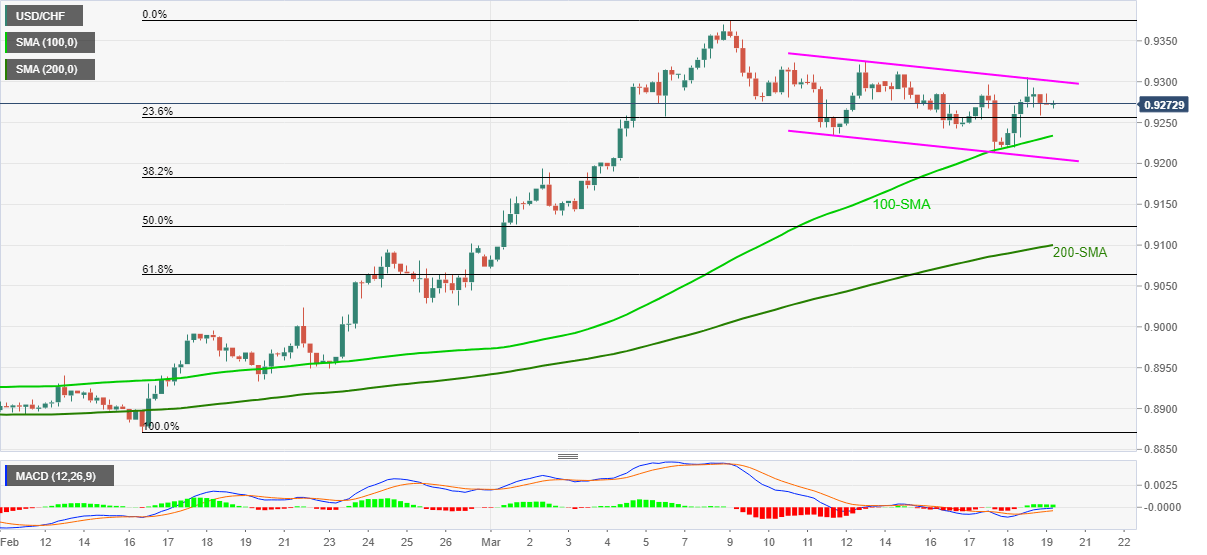

USD/CHF Price Analysis: Mildly bid towards 0.9300 inside weekly falling channel

- USD/CHF keeps bounce off intraday low inside a bearish chart pattern.

- Bullish MACD, sustained recovery from 100-SMA favor buyers.

- Sellers can eye 200-SMA on the downside break of the stated channel.

USD/CHF stays firm around 0.9275, up 0.18% intraday, while heading into Friday’s European session. In doing so, the quote justifies Wednesday’s recovery moves from 100-SMA while staying inside a short-term descending channel, a bearish chart pattern.

However, bullish MACD and the pair’s ability to stay above the key SMAs favor buyers targeting the stated channel’s resistance line, at 0.9300 now.

Should USD/CHF bulls manage to defy the bearish formation, the monthly high of 0.9375 and the mid-July 2020 top surrounding 0.9470 should return to the chart.

Meanwhile, 100-SMA and the channel support, respectively around 0.9235 and 0.9205, will precede the 0.9200 threshold during the quote’s fresh downside.

In the case where USD/CHF sellers refrain from respecting the 0.9200 round-figure, the 200-SMA level of 0.9100 will be in focus.

USD/CHF four-hour chart

Trend: Bullish