US Dollar Index Price Analysis: DXY remains pressured inside immediate falling channel

- US dollar index stays depressed for the second consecutive day.

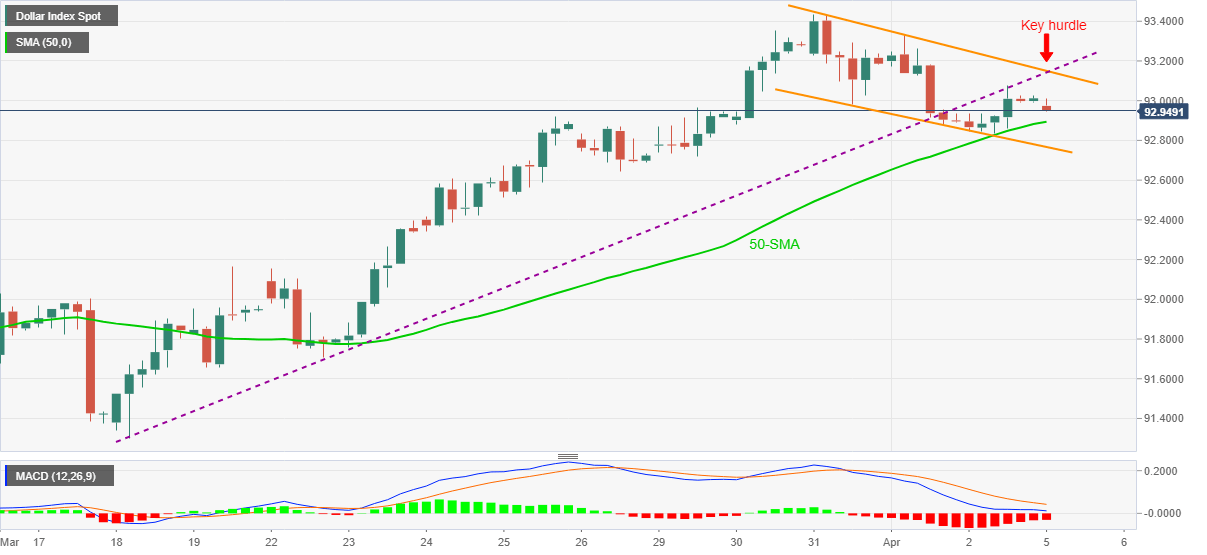

- 50-SMA, channel’s support can test the sellers, 93.13-15 becomes the hurdle to the north.

US dollar index (DXY) drops to 92.95, down 0.07% intraday, during early Monday. In doing so, the greenback gauge remains depressed inside a three-day-old bearish chart formation.

Although downbeat MACD signals back the DXY’s further declines, 50-SMA and the stated channel’s support line, respectively around 92.90 and 92.75, will challenge the further downside.

In a case where the US dollar bears dominate past-92.75, 92.60 can offer an intermediate halt during the fall targeting the 92.00 threshold.

Alternatively, a confluence of the previous support line from march 18 and the upper line of the channel, near 93.13-15 becomes the key resistance to watch during the quote’s recovery moves.

If at all the index rises past-93.15, it also confirms a bullish flag formation and can refresh the multi-day peak above the recent 93.46 level while eyeing the late 2020 levels above 94.00.

Overall, the US dollar index stays short-term weak but the uptrend hasn’t faded yet.

DXY four-hour chart

Trend: Further weakness expected