XAU/USD precious metal steady as investor risk appetite likely unchanged post the Fed

- Gold remains largely unchanged as risk appetite will be unchanged post the Fed statement.

- Fed remains committed to supporting the economy through accommodative policy.

- Fed commits to maintaining its bond buying of $80 billion per month.

As expected the Fed left rates unchanged and the accompanying statement did little to surprise investors.

The doveish tone continues as the Fed says the economy has strengthened and inflation effects are likely transitory. The Fed says indicators of economic activity are improving and employment has strengthened but says sectors most affected by the pandemic remain weak but have shown improvement.

The US 10 Year yield briefly moved up toward session highs on Wednesday at 1.661% but is currently retracing toward 1.63%.

Market Reaction

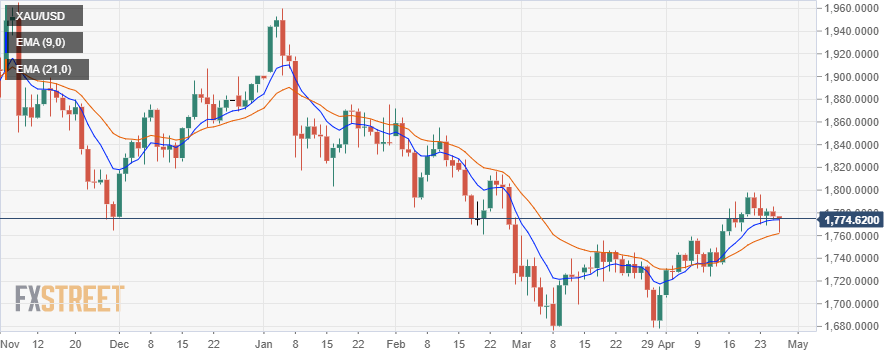

Gold is currently trading at $1,775 unchanged from just before the release of the FOMC statement and decision.

The previous double bottom support at the $1,760 level remains untested. The short-term moving average also acts as support at $1773. Any inflation fears that may be stoked during the FOMC press conference will see Gold test highs toward $1,800 in the short term.