Palladium Price Analysis: XPD/USD bullish impulsive remains intact above $2800

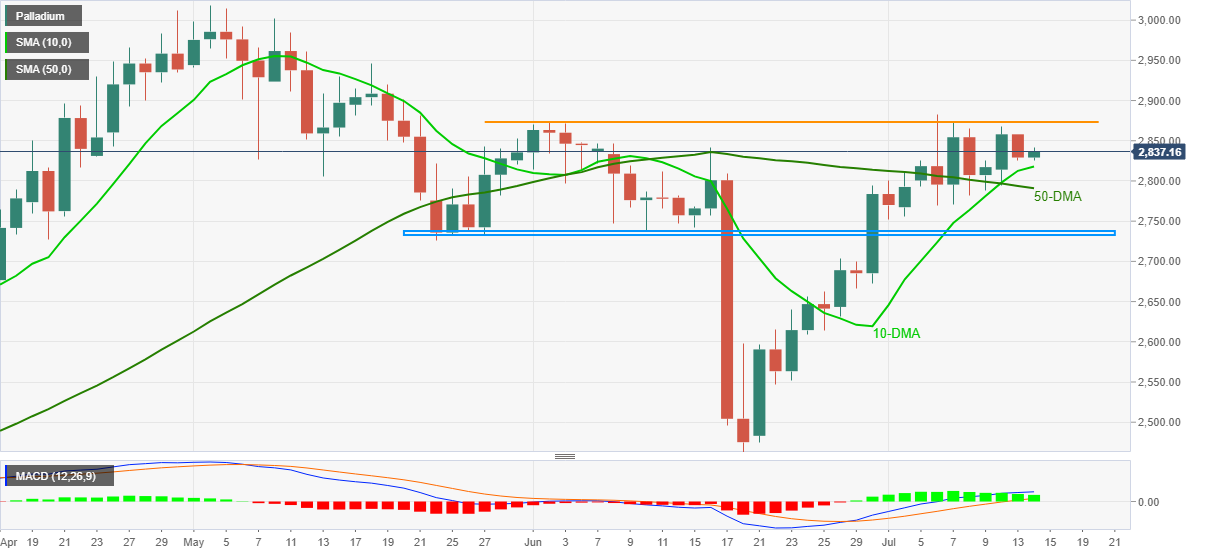

- Palladium struggles to keep bounce off 10-DMA, retreats of late.

- Bullish MACD, sustained trading above 50-DMA direct bulls to six-week-old hurdle.

- Horizontal support from late May holds the key to bear’s entry.

Palladium (XPD/USD) prices pare early Asian gains around $2,837, up 0.27% intraday, ahead of Wednesday’s European session. In doing so, the commodity prices fade bounce off 10-DMA.

However, bullish MACD signals and the quote’s ability to stay beyond 50-DMA keep XPD/USD buyers directed towards a horizontal resistance comprising multiple highs since early June, around $2,875.

During the quote’s sustained break of the $2,875 key hurdle, an upward trajectory to the $2,900 threshold becomes imminent. Though, any further advances will be tested by late May’s swing high near $2,945 and the $3,000 psychological magnet before fueling palladium prices towards the yearly top near $3,020.

On the flip side, a daily closing below the 10-DMA level of $2,818 will need validation from 50-DMA support of $2,790 to recall short-term sellers.

Even so, a horizontal area around $2,730-35, including multiple lows marked since late May, will be the key to watch afterward.

Palladium: Daily chart

Trend: Bullish