Gold Price Forecast: XAU/USD eyes $1736 and $1729 supports as rebound falters – Confluence Detector

- Gold’s rebound appears capped, as DXY holds the higher ground.

- Strong US NFP jobs ramp up Fed’s tapering expectations.

- Gold Weekly Forecast: Eyes $1,750 on NFP-inspired USD strength

Gold has stalled its recovery from five-month lows of $1688, having failed to find acceptance above $1750, as the US dollar continues to hold the recent gains fuelled by Friday’s NFP data. A big beat on the US employment report fanned expectations of earlier Fed tapering. Investors now assess the implications of a sooner than previously thought Fed’s monetary policy assessment, with all eyes on this week’s US inflation report.

Read: Gold Price Forecast: XAU/USD confirms a bearish breakdown, remains vulnerable

Gold Price: Key levels to watch

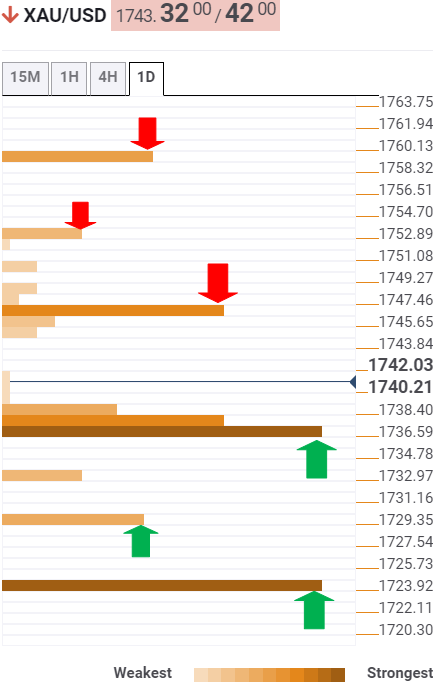

The Technical Confluences Detector shows that gold is heading towards powerful support at $1736, which is the convergence of the pivot point one-month S2, pivot point one-week S1.

The next relevant downside target is seen at $1729, the pivot point one-day S2.

Further south, the bears will need to beat the fierce cap at $1723, the Fibonacci 161.8% one-month.

On the flip side, the confluence of the SMA5 four-hour and pivot point one-day S1 at $1746 will offer a stiff resistance on any fresh upside attempts.

Gold buyers will then target $1752, the intersection of the previous high four-hour. Gold price turned south from that level after failing to find acceptance above it.

The next resistance awaits at the previous day’s low of $1759.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.