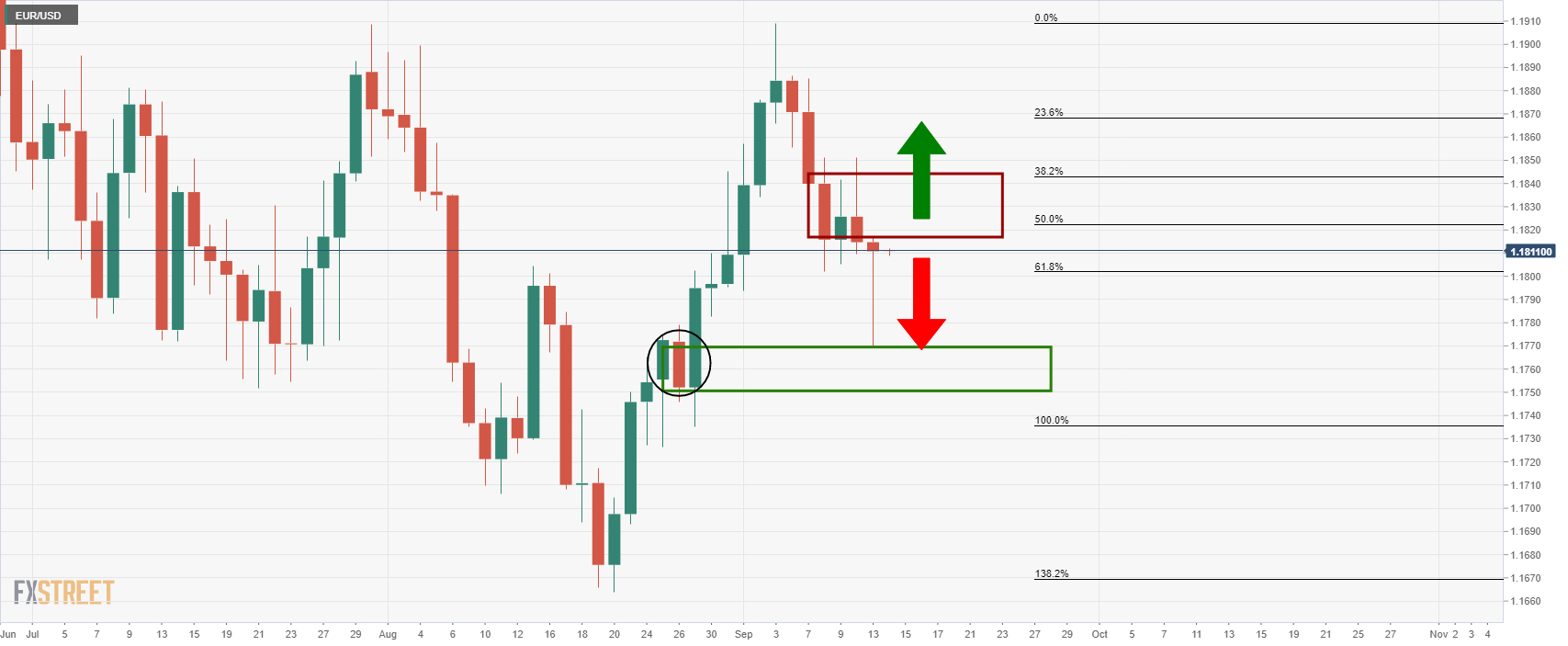

EUR/USD Price Analysis: Bulls struggle to close in the green, bears eye 1.1780

- EUR/USD bull need to clear the 38.2% Fibo or risk losing control to the bears.

- Bears eye a break to the old support structure on the daily and hourly time frames.

The price is resting near a 61.8% ratio and will be on the verge of a break to the upside if it can get above the 38.2% ratio again near 1.1845.

However, there is a compelling case for the downside and for a restest old structure. The following illustrates the prospects for both the upside and downside from a daily and hourly point of view.

(Daily chart)

The price closed the day on Monday negative and that leaves prospects of a retest of the lows for the sessions ahead.

(Hourly chart)

From an hourly perspective, the bears can move in on the 50% mean reversion located near the neckline of the W-formation around 1.1790. Below there, the daily structure is located near 1.1780. First, the newly formed level of support needs to give and this is located near 1.18 the figure.