Palladium Price Analysis: XPD/USD keeps pullback from monthly resistance above $2,300

- Palladium remains depressed near intraday low, down for the second consecutive day.

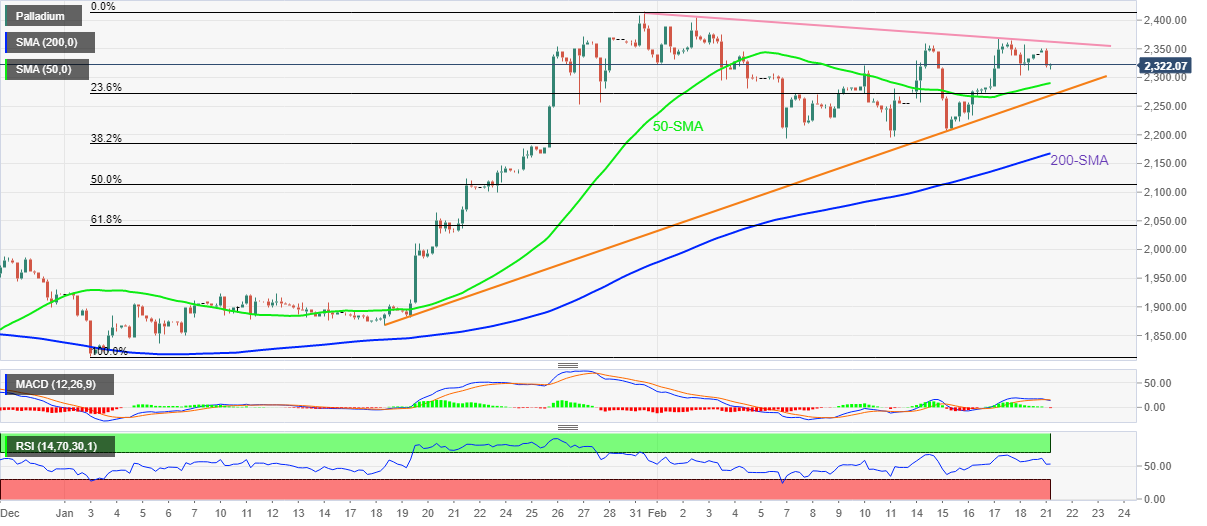

- Descending trend line from January-end restricts immediate upside.

- Bearish MACD signals favor pullback moves, 50-SMA, five-week-old support line challenge sellers.

Palladium (XPD/USD) prices stay on the back foot for the second day in a row, down 0.70% intraday around d $2,325 heading into Monday’s European session.

The precious metal took a U-turn from a three-week-old descending resistance line the previous day as MACD teased bears.

Given the recently softer RSI line also backing the bears, the XPD/USD prices may retest the 50-SMA level of $2,290.

However, an upward sloping trend line from January 18, near $2,265, will challenge the palladium bears afterward, a break of which will direct the quote towards the 200-SMA level of $2,167.

Meanwhile, a clear upside break of the stated resistance line, near $2,360 at the latest, will direct XPD/USD bulls towards January’s peak of $2,415 before highlighting the late August 2021 swing high near $2,470.

Overall, palladium prices grind higher but bulls are not out of the woods.

Palladium: Four-hour chart

Trend: Further weakness expected